Ultimately, it's about stewardship: Church financial management is not just about numbers; it’s about stewardship, ensuring that the church can thrive, serve, and plan for the future effectively.

Most problems start with poor organization: Without proper systems, financial management can quickly become messy, leading to issues with monthly reports, designated funds, and budget planning.

Ruthlessly seek out clarity: A lack of clear financial processes, policies, or tools can introduce significant challenges. Establishing these can bring clarity, accountability, and sustainability to church finances.

Good processes bring good results: The good news is that with a proper approach, these issues can be resolved, preventing them from becoming a dead end.

Church financial management isn’t just about numbers on a spreadsheet—it’s about stewardship. It’s about making sure your church can thrive, serve well, and plan boldly for the future.

But without the right systems in place, things can get messy—fast.

- Monthly reports don’t add up, leaving you guessing about giving trends.

- Designated funds blur together, creating accounting nightmares (and breaking trust).

- Budget planning feels more like plugging holes than casting vision.

At the core, these challenges usually come down to one thing: a lack of clear financial processes. Maybe the right tools aren’t in place. Maybe policies haven’t been set. Either way, the good news is—this isn’t a dead end.

With the right approach, you can bring clarity, accountability, and sustainability to your church’s finances.

This guide will walk you through key principles, best practices, and practical resources—so you can move forward with confidence, supported by robust church financial software.

I wrote this article with significant contributions from Carrie Gordon, a church financial administrator and professional bookkeeper with 30+ years of experience working with church budgets of all sizes. Today, Carrie is a financial administrator for Elora Road Christian Fellowship and leads CG & Associates, a bookkeeping firm.

Financial Management Starts with Stewardship

Faithful stewardship is a practice necessary at every level of ministry, from a member's financial habits to ministry spending to the strategic decisions made at the highest level of church leadership.

Financial stewardship is biblical, and part of our spiritual formation as pastors. Stewardship is rooted in the constant work to trust Jesus as provider . It requires contending with our built-in desires for control.

Joshua Gordon

Ultimately, stewardship starts with the church finance committee, which must answer the fundamental question, "How can we ensure our spending will take us where Jesus is leading?" That is the underlying principle that undergirds successful management of your church's finances.

The Importance of Transparency and Accountability

Trust isn’t built on good intentions—it’s built on clear, consistent action. Financial integrity isn’t just a best practice; it’s the foundation of a thriving church. When members know their giving is handled with wisdom and accountability, confidence grows.

These 5 practices will support your church's efforts for transparency:

- Regular financial reporting – Keep the congregation and leadership informed with clear, consistent updates.

- Oversight committees – A strong finance team ensures budgets and spending align with the church’s mission.

- Dual authorization – Major expenses should never be a solo decision. Require two approvals to safeguard against mismanagement.

- Annual external audits – An outside review ensures accuracy and reinforces trust.

- Clear donor communication – People give more when they see the impact. Be transparent about where funds go and honor designated gifts.

The Core Components of Church Financial Management

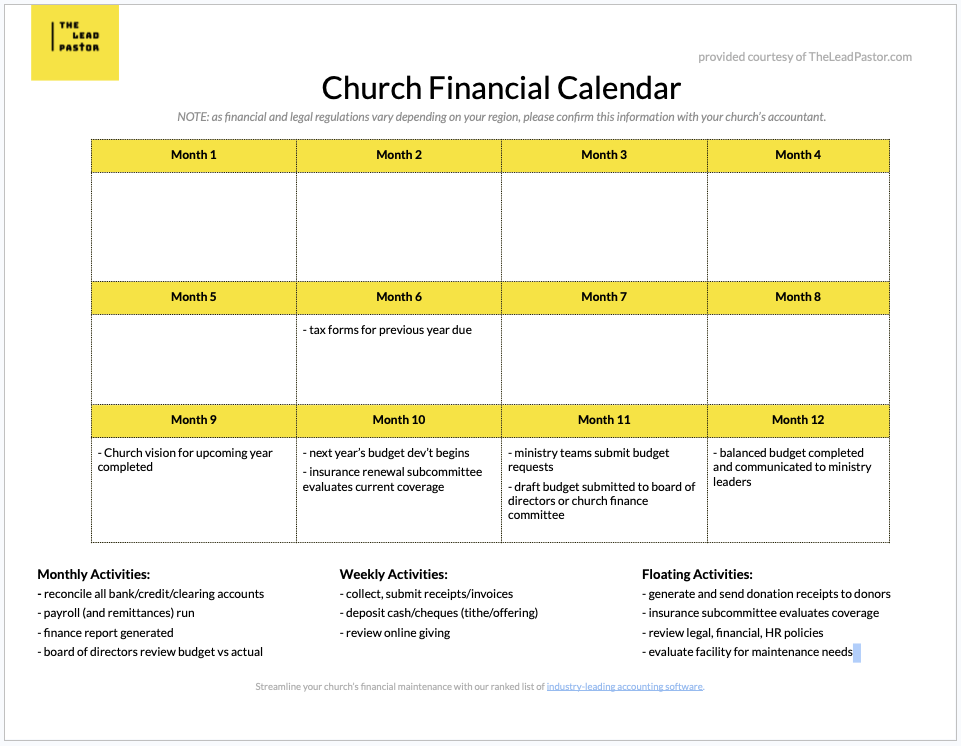

Successfully managing your church finances requires carrying out a set of activities based on your church's fiscal year (with financial records being stored according to church record management best practices). Every church's financial calendar will be slightly different. Here, we unpack the fundamental structure of the typical church's financial activities over the course of its fiscal year.

Generally speaking, two major financial events anchor a church's financial management efforts:

- The church budget

- Tax season

Most other activities revolve around, support, or are directly impacted by these two key events.

Yearly Church Financial Activities

Your church should be doing four primary activities each fiscal year. Of course, there are many more activities than this - these four are the main umbrellas under which most other activities are nested.

- Develop a budget that supports the church's vision.

- Prepare for tax season by generating donation receipts for donors (using Quickbooks, for example) and submitting proper forms to the IRS (or CRA in Canada).

- Review insurance coverage so you're not under or over-insured.

- Review legal, financial, and HR policies to remain compliant and streamlined.

In this article, we'll examine each of these more closely and discuss quarterly, monthly, and weekly activities that further flesh out the rest of your financial management responsibilities.

How to: Develop Your Church Annual Budget (in Four Straightforward Steps)

The church budget ensures that spending in your church is aligned with the mission and vision laid out by church leaders. This should be complete and in place by the start of the fiscal year - but the process should begin 3-4 months before then.

First, the lead pastor prepares a vision statement for the church.

The vision charts the course for the upcoming year and is critical to helping your ministry leaders prioritize their spending. Once complete, the vision should be shared with the senior leadership and communicated to the church and ministry leaders.

Timeline: Develop your annual church vision 3-4 months before the end of the fiscal year.

Second, the Church Finance Committee initiates the development of the annual budget.

This begins with a notice to the various ministry team leaders. Ask them to submit their requests for financial support for the upcoming year and direct them to plan their spending in alignment with the year's vision.

The treasurer, bookkeeper, and church accountant work together to forecast necessary expenditures (payroll, facility, etc.) and project revenue (donations, income, church grants, etc.) for the upcoming year.

Timeline: The budget development process should begin 3 months before the end of the fiscal year.

Next, the church treasurer presents the first draft of the budget to the Church Finance Committee.

This draft budget should include all of the requests received from each ministry team and the forecasted revenue and additional expenses. Note that this initial draft will almost always be deep in the red. The finance committee must then prayerfully review the budget.

Timeline: 1 month prior to the end of the fiscal year.

Lastly, the Church Finance Committee oversees the development of the final balanced budget.

The church leadership should meet with each ministry team, helping them prioritize their projected spending to balance the budget. The church finance committee should also explore various ways your church can increase revenue.

Timeline: The budget should be balanced by the beginning of the fiscal year.

How to: Prepare for Tax Season

First, you need to provide receipts for your donors/members. Generating and dispersing those receipts is typically the treasurer's responsibility, in conjunction with the bookkeeper and accountant. Your church's accounting software plays an important part in this process, the least of which is keeping you operating within church accounting guidelines.

Timeline: Send donation receipts 6-8 weeks prior to your country's tax deadline.

(confirm with your accountant!)

Second, you need to know the deadline for non-profit/charity reporting. Maintaining charitable status requires compliance with governmental guidelines. For churches in the United States, find guidelines in IRS Publication 1828. Churches in Canada must complete and submit Form T3010, Registered Charity Information Return, annually within six months of the end of their fiscal year.

Timeline: File appropriate documents with 6 months of the end of your fiscal year.

(confirm with your accountant!)

How to: Review Your Insurance Coverage

Ensure that your coverage is adequate for your church's anticipated needs. We recommend appointing a sub-committee of your church finance committee (or board of directors) to consult with an insurane broker to review your coverage and ensure you're not under-insured (or over-insured) for the year ahead.

Timeline: Begin 1-2 months before annual insurance renewal

How to: Review Legal, Financial, and HR Policies

Annually reviewing your church's various policies will ensure nothing is outdated or irrelevant. It will also help maintain compliance, financial integrity, and effective staff management. Appoint a subcommittee to meet with relevant ministry leaders and recommend any new regulations (or for removing regulations) that maintain standards and safeguard the church.

Timeline: Review legal, financial, and HR policies 3-4 months before the end of the fiscal year

Strategies for Fundraising and Giving

A healthy church doesn’t rely on Sunday offerings alone. Encouraging generosity requires creativity and intentionality. Here are a few ways to cultivate sustainable giving:

- Church-based revenue – Rentals, book sales, or community events can generate additional income to support ministry.

- Online giving platforms – Make tithing effortless with digital and recurring giving options.

- Creative church fundraisers – Rally the congregation around specific needs like missions, building projects, or community outreach.

- Legacy giving programs – Inspire long-term impact by encouraging planned gifts through wills and estate contributions.

Monthly Financial Management Activities

First, ensure the individual handling your church bookkeeping is preparing payroll for staff, submitting payroll remittances, and completing all relevant data entry (note: minimize human error with industry-leading church payroll software).

Second, your treasurer should generate a monthly church finance report. Our team has prepared precise directions for generating church finance reports and several useful downloadable templates.

Third, the treasurer should do monthly reconciliations. Look at bank accounts, credit card accounts, and any clearing accounts. This regular maintenance helps spot errors or unexpected transactions quickly and allows the treasurer to provide clean reports for board meetings

Also, the church finance committee should meet monthly to review financial reports, approve out-of-budget expenses, and ensure that financial activity aligns with the church's vision.

Weekly Financial Management Activities

These activities should be worked into your weekly schedule - and many of them can be accomplished with the aid of apps designed to streamline these administrative tasks.

- Collect and submit receipts for any purchases made during the week.

- Review donations made online and cash/cheques collected onsite. Ensure that cash/cheques are handled according to your church's policy.

- Deposit offerings/tithes (cash/cheques) at your bank promptly, updating your church tithe records as needed, according to government regulation..

Church Financial Management Best Practices

Lead pastors are responsible for laying out a vision for the upcoming year to direct budget preparations. By actively participating in this early stage, pastors can ensure the budget aligns with the church’s spiritual and operational objectives.

Lead pastors play a significant role in their churches' financial health and management. By actively participating in the budgeting process and maintaining a clear vision, they can ensure that the church's financial practices support its mission and values."

A board of directors must be proactive rather than reactive, especially regarding financial planning and budget discussions. Early and informed interventions can prevent many challenges associated with last-minute financial decisions. Hence the importance of regular meetings to evaluate the financial health of a church.

Related Software Tools:

- Church Database Software For Information Management

- Worship Presentation Software For Mac

- Church Administration Software For Church Management

Stick with Us: Join TheLeadPastor.com Newsletter!

For more seasoned insight from ministry veterans, subscribe to TheLeadPastor.com email list. We'd love to have you.