Managing church finances makes me feel like a fish out of water. Like many pastors, I'm far more comfortable in the pulpit or counseling office than I am dealing with budgets and spreadsheets. That's why finding the right church accounting software is crucial. The right software solution reduces the time and energy I spend with numbers, and frees up focus for the parts of ministry that make my soul come alive.

Today, I'll guide you through the latest trends, benefits, and pricing options to help you choose the best church accounting software for your congregation. From automated fund tracking to seamless donor management, I'll break down what you need to know so you can focus on what matters most: shepherding your community. Let's dive in!

13 Best Church Accounting Software Shortlist

Here's my pick of the 13 best software from the 29 tools reviewed.

Why You Should Trust Our Reviews

Simply put, we’ve been testing and reviewing church accounting software for years now (since 2019). As pastors and church leaders ourselves, we understand how critical and how difficult it is to make the right decision when selecting accounting software.

To that end, we've invested significantly in deep research. Our team has tested over 2,000 tools for different church operations use cases and written over 1,000 comprehensive software reviews. (Learn how we stay transparent & our church accounting software review methodology)

The 13 Best Church Accounting Software Summary

| Tools | Price | |

|---|---|---|

| QuickBooks Online | From $15/user/month | Website |

| MinistryPlatform | Pricing upon request | Website |

| ChMeetings | From $12/month | Website |

| AccountEdge Pro | From $20/user/month (billed annually) | Website |

| IconCMO | No price details | Website |

| ACS | No price details | Website |

| Blackbaud Financial Edge NXT | Pricing is available upon request | Website |

| Botkeeper | From $69/license/month | Website |

| ZipBooks | From $15/month (5 users) | Website |

| MIP Fund Accounting | Pricing is available upon request | Website |

| PowerChurch Plus | costs from $395 | Website |

| Xero | From $14.50/user/month | Website |

| Sage Intacct | From $595/user/year | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose Church Accounting Software

We’ve worked with enough pastors and churches to understand that each church’s decision-making process differs. So, as you work through your unique software selection process, keep the following points in mind:

- Ensure the software provides robust budgeting tools. Churches often work with tight budgets and need software that simplifies the tracking of income and expenses across multiple funds. For instance, tracking general fund donations separately from mission fund contributions is essential.

- Look for software that can track donations and generate detailed reports. Accurate donor records, like tax receipts or yearly contribution summaries, are crucial. A church might need a specific breakdown for building funds or outreach programs, which the right software can handle.

- Prioritize a user-friendly interface. Volunteers often handle accounting tasks. Choose software with a simple, intuitive interface, minimizing training time. For example, clear dashboards help volunteers monitor key metrics without needing an accounting background.

- Your choice should integrate with existing management and payroll systems. Avoid redundant data entry! For example, if your church already uses Planning Center or Fellowship One, select accounting software that supports data syncing with those tools.

- Ensure the software provides compliance and audit support. Churches must meet financial compliance standards and undergo regular audits. The software should streamline compliance with features like audit trails, customizable charts of accounts, and fund accounting. For example, ensuring clear separation between restricted and unrestricted funds will simplify audits.

Overviews Of The 13 Best Church Accounting Software

Here’s a brief description of each of the church accounting software on my list, showing what it does best, plus screenshots to showcase some of the features.

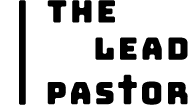

QuickBooks Online is a versatile, cloud-based accounting software tailored to meet the needs of small to medium-sized businesses, including specialized sectors like churches requiring unique financial management features. Its comprehensive set of features and user-friendly interface position it as a suitable choice for businesses seeking a robust bookkeeping solution that can handle a variety of financial tasks.

Why I picked QuickBooks Online: This software excels as church accounting software by offering customizable accounting solutions, donation tracking, and financial reporting tailored to the specific needs of religious organizations. Additionally, the software helps automate tax preparation for non-profits and maintain compliance with tax regulations.

A huge differentiator is its capability to automate various bookkeeping tasks, which can be particularly beneficial for churches with limited accounting staff.

QuickBooks Online Standout Features & Integrations

Features that make this software stand out include donation tracking which helps you simplify donation management which is critical for accurate donor records and financial transparency. Also, its fund accounting helps track designated funds and grants accurately.

Integrations include PayPal, Square, Shopify, Stripe, Gusto, TSheets, Bill.com, Hubdoc, Receipt Bank, Fathom.

MinistryPlatform is a church management software designed for large churches, parishes, dioceses, and denominational offices. It offers a powerful and flexible platform that centralizes parishes, people, and operations in a single database.

Why I picked MinistryPlatform: It offers robust tools for managing donations, tracking contributions, and generating detailed financial reports. The platform supports multiple donation methods, including online giving, text-to-give, and mobile donations through the PocketPlatform app, ensuring seamless and efficient handling of church finances. Its real-time reporting capabilities also provide church leaders with up-to-date financial data to help maintain transparency.

Furthermore, MinistryPlatform's advanced dashboard and reporting tools allow church administrators to create customizable dashboards and generate detailed reports that provide valuable insights into the church's financial health. The integration of financial stewardship tools with other administrative features ensures a cohesive approach to managing church finances.

MinistryPlatform Standout Features & Integrations

Features include volunteer management, event scheduling, customizable dashboards, real-time reporting, donor management, secure database access, detailed financial analytics, mobile app integration, workflow automation, attendance tracking, email and texting communication tools, and pledge management.

Integrations include PCO Connect, BIS, Checkr, MinistrySafe, Twilio, Message Metrics, SendGrid, Generosity, OnlineGiving, Vanco, and Tithe.ly. It also supports REST APIs to connect to any data source.

ChMeetings is a comprehensive church management software designed to assist churches in organizing their operations. It offers a range of features including member and event management, financial tracking, communication tools, and volunteer scheduling.

Why I picked ChMeetings: As a church accounting software, ChMeetings allows users to manage finances by tracking expenses, monitoring funds, and generating visual reports for financial insights. The software also integrates accounting functions with other church operations, enabling the addition and management of transactions, accounts, funds, categories, and payees. This integration helps churches maintain accurate financial records and perform reconciliations without requiring advanced accounting knowledge

Users can also create tailored budgets and track progress, giving visibility into available resources to help the church achieve its goals. Furthermore, the platform is known for accommodating different church sizes, with various priced plans and a free plan available.

ChMeetings Standout Features & Integrations

Features that make this software stand out aside from its accounting abilities include member profile management, event booking and check-in, outreach, confession appointments, event calendar, donations, online payment, ad-hoc forms, and granular access control. The platform is also GDPR-ready, secure, and available in multiple languages.

Integrations include MailChimp, PayPal, Twilio, and SMSGlobal. It also offers a developer API.

AccountEdge Pro is a small business accounting software that provides advanced financial management and inventory tracking tools.

Why I Picked AccountEdge Pro: AccountEdge Pro is a comprehensive accounting software designed for small businesses (or churches) that provides advanced financial management and inventory tracking tools. AccountEdge Pro offers a wide range of financial management tools such as invoicing, billing, and tracking of expenses. It also provides detailed financial reporting and analysis capabilities, allowing users to track their business's financial performance and make informed business decisions.

AccountEdge Pro is designed to be user-friendly and easy to navigate, allowing users to quickly and easily manage their finances and inventory. It also offers a variety of tutorials and support resources to help users get started.

AccountEdge Pro has inventory tracking and sales tax calculations if you sell anything through the church, like Bibles, t-shirts, or event tickets.

The one-time fee option for Windows is great for churches who aren't looking for a monthly software-as-a-service subscription, which can really add up cost-wise over time. One payment and you own it forever. Unfortunately, the single-use license isn't available for Mac, which offers a per-month subscription only.

AccountEdge Pro Standout Features & Integrations

Features include financial management, inventory management, contact management, sales tax, payroll, time billing, job costing, multi-currency, and third-party integrations/add-ons.

Integrations include QuickBooks, Salesforce, Square, Microsoft Excel, TSheets, Harvest, and most bank feeds.

IconCMO is a church management software that provides tools for membership management, contributions and donations management, financial management, event management, communication, and reporting.

Why I Picked IconCMO: IconCMO is a church management software that excels in several areas like fund management, membership management, accounting, and collaboration.

IconCMO is super easy to navigate and intuitive to use. The interface is user-friendly and straightforward, making it easy for churches to manage their information.

IconCMO provides robust financial management capabilities, including accounting, budgeting, financial reporting, and revenue recognition. Users appreciate the software's ability to track income, expenses, and donations and generate financial statements.

IconCMO does more than just accounting, too. It offers tools for tracking member information, including contact details, attendance, and giving history. Pastors can manage member information and create custom attendance and donations reports. IconCMO even allows churches to schedule, register, and track attendance for events, such as classes, meetings, and fundraisers.

IconCMO is a great 'jack-of-all-trades' software with tools for modern church communications including email, text messaging, and social media, alongside everything you expect from a church accounting software.

IconCMO Standout Features & Integrations

Features include membership management, financial management, event management, communication, reporting, online giving, mobile access, security, cloud-based, and third-party integrations/add-ons.

Integrations include Vanco, PayPal, Stripe, Elavon, First Data, Authorize.net, ADP, Paychex, QuickBooks Online, Xero, Church Community Builder, Fellowship One, Planning Center, MailChimp, Constant Contact, Emma, Facebook, Twitter, and LinkedIn.

ACS Technologies is a provider of church management software that offers a range of solutions for church administration, including membership management, accounting, donation tracking, and communication tools.

Why I Picked ACS Technologies: ACS Technologies is highly praised for its church accounting features which are designed to meet the specific needs of churches. The software provides a variety of tools to help churches manage their finances, including donation tracking, budgeting, and reporting.

ACS Technologies provides a general ledger, accounts payable, accounts receivable, and cash management capabilities, which enable churches to manage their financial information and produce financial statements. It also allows churches to easily track donations and pledge payments, including automatic deposit of electronic funds, and generation of donation statements for tax purposes.

ACS Technologies has great budgeting and forecasting capabilities that allow churches to set and track budgets, and compare them to actual financial performance. Plus, it provides a wide variety of financial reports, including income statements, balance sheets, and giving reports, which helps churches to analyze their financial data and make informed decisions.

Overall, ACS Technologies is seen as a powerful and flexible church management software that can help churches streamline their financial processes, improve efficiency, and make more informed decisions with real-time financial data.

ACS Technologies Standout Features & Integrations

Features include membership management, contributions & donations management, financial management, event management, communication, reporting, security, mobile access, cloud-based, and third-party integrations/add-ons.

Integrations include ADP, Paychex, Vanco, Breeze, Salesforce, Microsoft Dynamics, WordPress, MailChimp, Constant Contact, Facebook, Twitter, Tableau, Power BI, and others.

Blackbaud Financial Edge NXT is an accounting software specifically designed for non-profit organizations, providing tools for financial management, donor management, grant management, and reporting.

Why I Picked Blackbaud Financial Edge NXT: Blackbaud Financial Edge NXT can help churches in several ways. First, it can help churches manage their finances effectively by providing a single, integrated platform for financial transactions, budgeting and forecasting, and financial reporting. This can help churches to keep track of their income and expenses, manage their budget, and make informed financial decisions.

Second, Blackbaud Financial Edge NXT can help churches manage their donor relationships. The software has a donor management feature that allows churches to track donors, process gifts, and manage fundraising activities. This can help churches to better understand their donors, identify trends in giving, and build stronger relationships with their donors.

Third, Blackbaud Financial Edge NXT can help churches manage their grant funding. The software has a grant management feature that enables churches to track grants, manage proposals, and report on grant-related activities. This can help churches to identify new funding opportunities, apply for grants, and manage the grant-related processes.

Overall, Blackbaud Financial Edge NXT can help churches to manage their finances and donor relationships more effectively, while also providing tools to help them comply with regulations and find new funding opportunities.

Blackbaud Financial Edge NXT Standout Features & Integrations

Features include financial management, general ledger, accounts payable & receivable, budgeting & forecasting, and financial reporting, donor management, grant management, reporting and analytics, including, customizable reports and dashboards, automated workflows and approvals, multi-user access and permissions, mobile app access, expense tracking, payroll processing, and third-party integrations/add-ons.

Integrations include Paycor, Blackbaud Raiser's Edge NXT, Procurify, MineralTree Invoice-to-Pay, Bellwether PO and Inventory, Windward Core, DBxtra, MartusTools, WorkPlace Requisition & Procurement, Planning Maestro, DLS Financials, contactSPACE, and Endowment Manager.

Botkeeper is an AI-powered bookkeeping software that automates financial tasks and provides real-time data insights for businesses.

Why I Picked Botkeeper: Botkeeper is an AI-powered bookkeeping software that is designed to automate many of the financial tasks that churches typically have to handle manually. One of the key features that Botkeeper excels at is its automation capabilities. The software uses advanced artificial intelligence algorithms to automate tasks such as data entry, bank reconciliation, and financial reporting. This allows church leaders to save time and reduce the risk of errors.

Another strength of Botkeeper is its ability to provide real-time data insights. Botkeeper is able to analyze financial data in real-time, providing churches with a clear picture of their financial health and performance. This allows them to identify trends, identify areas for improvement, and make more informed decisions about their financial strategies.

Botkeeper also offers a great customer support, which ensures that any issues or concerns are addressed quickly. The software is user-friendly and easy to navigate even for those with little or no accounting experience. Furthermore, Botkeeper is cloud-based, which means that churches can access their financial information and data from anywhere at any time.

Botkeeper Standout Features & Integrations

Features include automated bookkeeping, analytics, ai, financial forecasting, customizable reports, multi-user access and permissions, cloud-based access, mobile app access, 24/7 customer support, reminders and notifications, billing and invoicing, expense tracking, payroll processing, budgeting, and third-party integrations/add-ons.

Integrations include Stripe, Gusto, QuickBooks, HubSpot, LinkedIn, Hootsuite, PayPal, Zendesk, Kissmetrics, and Chargify.

If you are looking for a software package with a free forever plan you can use to manage your church’s bookkeeping needs, you may want to consider ZipBooks. ZipBooks is a cloud-based accounting software that provides small business owners with easy-to-use financial management tools. Though not church-specific software, it can of course be used by churches.

Why I Picked ZipBooks: ZipBooks is a user-friendly accounting software designed for small businesses and not-for-profits. One of the things that ZipBooks does well is its ease of use. It has a simple, intuitive interface that allows users to quickly navigate through the different features and functions, making it easy for even those with little or no accounting experience to use. ZipBooks also offers a wide range of features that help small businesses manage their finances, including invoicing, expenses tracking, and financial reporting.

Another strength of ZipBooks is its flexibility. ZipBooks can be accessed from any device with an internet connection, making it easy for users to access their financial information from anywhere at any time. Additionally, ZipBooks offers a variety of integrations that allow users to connect their accounting software with other tools they use in their business, such as payment processors, time tracking software, and more. This makes it easy for small business owners to manage their finances and streamline their workflow.

ZipBooks has the ability to automate many tasks and provide real-time data which helps in better decision making. ZipBooks is also cost-effective and offers a free version which can be upgraded to the paid one for more advanced features.

ZipBooks Standout Features & Integrations

Features include invoicing and billing, expense tracking, financial reporting, online payments, bank and credit card reconciliation, sales tax tracking, multi-currency support, time tracking, project management, team collaboration, customizable templates, mobile app support, customizable dashboards, data import and export, automatic bookkeeping, budgeting and forecasting, payroll support, inventory management, tax compliance, and third-party integrations/add-ons.

Integrations include Google Drive, PayPal, Slack, Google Workspace, Asana, Gusto, Spiceworks, and Enrollsy.

MIP Fund Accounting is a financial management software specifically designed for nonprofit organizations, government entities, and other organizations that need to track and report on multiple funds or grants, with features such as fund accounting, budgeting, and reporting capabilities.

Why I Picked MIP Fund Accounting: MIP Fund Accounting is praised for its robust fund accounting capabilities, allowing organizations to track and manage multiple funds and grants effectively.

MIP Fund Accounting can also handle complex financial reporting, including government and grant reporting, as well as the flexibility to customize reports to meet the specific needs of their organization.

In addition to that, the software is also well known for its budgeting capabilities, that allow organizations to set and track budgets for individual funds or grants, and compare them to actual financial performance.

Overall, MIP Fund Accounting software is a powerful and comprehensive financial management tool that can help churches effectively track and manage multiple funds and grants, while providing the necessary reporting and budgeting capabilities to support their decision-making processes.

MIP Fund Accounting Standout Features & Integrations

Features include fund accounting, budgeting, financial reporting, accounts payable, payroll, general ledger, grant management, mobile access, and third-party integrations/add-ons.

Integrations include Diversified Billing, Martus, TripLog, Paypool, CUSI, and SkyStem ART.

Other Options: Our Honorable Mentions

While these ones didn’t crack our top 13, they’re worth mentioning (and worth exploring for you, as well!)

Need more than just church accounting functionality? We've rated and ranked top management software solutions for churches.

Related Church Software Reviews

Most churches rely on software tools to keep things organized and working smoothly. We've thoroughly researched the top industry tools available to simplify your decisions. Our reviews will help you:

- Build a cohesive, compelling website to anchor your online platform.

- Ensure your day-to-day church bookkeeping runs smoothly.

- Reduce your admin load with industry-leading church management solutions.

- Keep payroll working without hiccups with the best church payroll software

Selection Criteria for Church Accounting Software

When evaluating church accounting software, I prioritize functionality and meeting specific news that most impact your efficient financial management. The right tool for your church should alleviate pain points, offer intuitive workflows, and align with your church's unique needs. I've personally tried and researched these tools, and my selection criteria focusses on these critical factors:

Core Software Functionality - 25% of Total Weighting Score:

Standard features for church accounting software typically include fund accounting, donation tracking, budgeting, payroll management, customizable reports, bank reconciliation, volunteer/staff permissions, multi-site support, and integration with donor management systems.

To be considered for inclusion on my list of the best church accounting software, the solution had to support the ability to fulfill common use cases:

- Managing designated funds for specific projects

- Tracking and acknowledging donor contributions

- Providing transparent financial reports for the congregation and board

- Automating payroll processing for staff and clergy

- Simplifying budgeting and expense forecasting

Additional Standout Features - 25% of Total Weighting Score:

- Advanced Fund Accounting: Support for endowment funds or restricted donations not offered by generic accounting solutions.

- Integrated Donor Management: Tight integration with CRM systems (like Breeze or DonorPerfect), preventing duplicate entries and streamlining financial reporting.

- Multi-Campus Management: The ability to manage financials across multiple campuses with consolidated reporting (like that offered by ACS Technologies)

- Customizable Role-Based Permissions: Ensure sensitive data remains secure while empowering staff and volunteers.

- Innovative Reporting Tools: Tailored financial statements and forecasting tools (like Aplos) provide new insights for strategic planning.

Usability - 10% of Total Weighting Score:

- User-Friendly Interface: Clear, organized dashboard with easy navigation.

- Customizable Dashboards: Tailor the display to prioritize relevant financial information.

- Drag-and-Drop Functionality: Streamline workflow adjustments, especially in budgeting and reporting.

- Role-Based Access: Easy-to-configure permissions for staff and volunteers.

Onboarding - 10% of Total Weighting Score:

- Interactive Product Tours: Hands-on experience that guides new users through the basics.

- Training Videos and Webinars: Practical resources that shorten the learning curve.

- Templates for Setup: Pre-built templates to simplify data migration.

- Chatbots and Help Guides: Provide quick answers to common questions.

Customer Support - 10% of Total Weighting Score:

- 24/7 Support Availability: Ensure help is always available, especially during crucial periods like year-end closing.

- Dedicated Account Manager: Personalized assistance for setup and troubleshooting.

- Live Chat Support: Real-time solutions to minimize workflow disruption.

- Comprehensive Knowledge Base: Articles and guides for self-service problem solving.

Value for Money - 10% of Total Weighting Score:

- Transparent Pricing: Clear tiers with no hidden fees.

- Flexible Plans: Monthly and annual plans that fit different budgets.

- Scalable Solutions: Features that grow with the church, adding value over time.

- Free Trials: Allow testing before committing.

Customer Reviews - 10% of Total Weighting Score:

- Consistent Positive Feedback: High satisfaction rates among similar-sized churches.

- Ease of Implementation: Quick setup times with minimal issues reported.

- Reliable Support: Responsive and knowledgeable support staff.

- Feature Effectiveness: Users highlight standout features that provide unique value.

Selecting the right church accounting software requires carefully evaluating how well each option fulfills these criteria. By focusing on your church's needs, bottlenecks, or pain points, you can more confidently choose a solution that aligns with your church's mission and financial goals.

Trends in Church Accounting Software

Since the beginning of 2024, church accounting software has evolved rapidly in response to the unique needs of churches, large and small. We examined the product updates, press releases, and release logs from popular tools (like Aplos, QuickBooks for Nonprofits, or Breeze), looking for emerging trends focusing on improving efficiency, enhancing transparency, and simplifying compliance. Here's how the landscape is developing this year:

Improved Integration and Automation

- Donor Management Integration: Tools like Aplos and QuickBooks for Nonprofits emphasize tighter integration with donor management systems, reducing duplicate entries and manual data imports.

- Automated Reconciliation: We're observing an increase in automated bank reconciliation features (highlighted in a recent ACS Technologies update) that streamline transaction matching and save staff time.

- API and Webhooks: For more advanced users, enhanced APIs and webhooks allow seamless data flow between accounting and other church management systems.

Advanced Reporting and Analytics

- Customizable Financial Statements: Software is increasingly offering customizable financial statements tailored to board and donor requirements. This helps churches maintain transparency (as seen in Aplos and Church Community Builder).

- Real-Time Dashboards: Tools like QuickBooks and Breeze have improved real-time dashboards, offering pastors immediate insights into giving trends, fund balances, and budget compliance.

- Predictive Analytics: New forecasting tools (as evidenced in Pushpay and Planning Center) leverage predictive analytics for more accurate budgeting and expense forecasting.

Simplified Compliance and Governance

- End-of-Year Tax Reporting: Year-end tax reporting is becoming more efficient, with enhanced features for creating IRS-compliant contribution statements and 1099 forms.

- Role-Based Access Controls: Many platforms now offer improved role-based permissions to limit access to sensitive data, ensuring compliance with governance policies.

Enhanced Usability and Support

- User-Friendly Interfaces: This is increasing across the board (e.g., QuickBooks, Breeze, and Aplos) as software companies redesign interfaces to make workflows more intuitive, particularly for volunteers and staff unfamiliar with accounting.

- Comprehensive Knowledge Bases: Companies like ACS Technologies and Planning Center are leading the way in providing extensive knowledge bases with video tutorials and detailed guides, reducing support requests.

Demand Shifts: What's Out

- On Decline - Printed Reports: With digital dashboards and statements gaining prominence, the demand for printed reports is declining.

- On Decline - Basic Bookkeeping: General-purpose bookkeeping features are in decline as churches seek specialized financial management tools.

These trends highlight the rapid evolution of church accounting software, driven by the need for greater integration, transparency, and ease of use. By staying ahead of these trends, lead pastors can ensure their churches have the right tools to streamline financial management and focus on ministry impact.

What is Church Accounting Software?

At its simplest definition, church accounting software helps churches manage their finances, members, and daily operations more effectively.

Think of it like having an all-in-one assistant that helps you handle payroll, create donation receipts, schedule events, and track who's attending your services—all from one place. Whether you're a small congregation or a multi-campus church, it's there to simplify the administrative load so you can focus on ministry.

Virtually all accounting software options include core features like fund accounting, donation tracking, and budgeting while also offering tools for managing volunteers, events, and communications.

Features of Church Accounting Software

Choosing the right church accounting software can make or break your financial management efforts. Here's a list of the most essential features to look for to deliver seamless and effective church accounting:

- Fund Accounting: This allows you to track designated funds for specific projects properly, enabling accurate management of your church's diverse financial activities.

- Donation Tracking and Reporting: This allows you to streamline donor contributions and easily generate donation receipts, ensuring transparency and strengthening member trust.

- Budgeting and Forecasting: this simplifies planning future expenses with built-in budgeting tools, helping your church allocate resources effectively and avoid overspending.

- Customizable Financial Reports: generating tailored financial reports for your board, congregation, or government compliance allows you clear insight into the church's economic health.

- Payroll Management: Managing staff and clergy payroll within the same system is a big bonus, as it ensures accurate and timely compensation.

- Bank Reconciliation: automatically reconciles your bank accounts and quickly identifies discrepancies, saving time and reducing errors.

- Volunteer and Staff Permissions: Set access controls based on user roles, protecting sensitive financial data while allowing appropriate staff and volunteers to contribute.

- Integration with Donor Management: Sync with your donor management system to prevent data inconsistencies and streamline financial reporting.

- Multi-Site Support: Manage financials across multiple campuses or ministries, keeping accounts separate while providing consolidated reporting.

- Scalability: Ensure your software can grow with your church, handling increased transaction volume, new ministries, and additional locations.

These features form the foundation of effective church accounting software. They help reduce administrative burdens, maintain transparency, and support strategic financial planning, ultimately empowering your church to focus on its mission.

Benefits of Church Accounting Software

Managing church finances is a complex responsibility, and it is infinitely more difficult without tools that provide accuracy and transparency. The right accounting software for your church will streamline financial processes and empower your church to fulfill its mission effectively.

Here are five primary benefits that lead pastors should consider:

- Accurate Fund Accounting: Enables precise tracking of designated funds. Get a clear picture of resource allocation to ensure transparency and compliance.

- Simplified Donation Management: This system automates donation tracking and reporting, allowing for consistent donor engagement and more efficient fundraising efforts.

- Enhanced Financial Reporting: This service offers customizable, detailed reports. Your board and staff can access insights into the church's financial health and make better decisions.

- Efficient Payroll Processing: Automates payroll for clergy and staff, ensuring accurate tax compliance and timely compensation.

- Time-Saving Automation: Reduces administrative burdens with automated reconciliation, budgeting, and forecasting, freeing up more time for ministry-focused activities.

By leveraging these benefits, lead pastors can enhance the accuracy and efficiency of their church's financial management and build trust with their congregations through greater transparency.

Using specialized accounting software helps pastors focus on their core calling while leaving the intricacies of financial management to the experts.

Joshua GOrdon

Costs & Pricing for Church Accounting Software

Pricing plans typically vary based on the church's size, complexity of financial needs, and desired features. Here's a breakdown of plan types and pricing options most common in the industry:

| Plan Type | Average Price | Common Features |

| Free | $0/month | Fund accounting, donation tracking, basic reporting, volunteer permissions |

| Basic | $25-$50/month | All Free features, budgeting, payroll processing, bank reconciliation |

| Standard | $50-$100/month | All Basic features, multi-site support, role-based permissions, custom reports |

| Advanced | $100-$200/month | All Standard features, donor management integration, advanced analytics, mobile app |

| Enterprise | $200+/month | All Advanced features, unlimited users, dedicated account manager, API access |

Selecting the right plan depends on your church's size and specific financial management needs. Consider starting with a free or basic plan to explore features. From there, commit to a more comprehensive option as your needs expand.

Frequently Asked Questions

How secure is church accounting software, and can it protect sensitive financial information?

Can I migrate existing financial data from our current system into new church accounting software?

How does church accounting software handle multiple currencies for international missions or donations?

Is it possible to integrate church accounting software with our existing church management system (ChMS)?

Join Our Newsletter.

We want everything we publish to be so good it's worth paying for... not that you'll pay for the newsletter. That's free. As a subscriber, you'll get the benefit of our support team:

- Exhaustively researched reviews of software. We point you to software that will save you time, energy, and money (so you can do more ministry.)

- Seasoned insight from veteran pastors and church leaders. We'll connect you with folks who know the deep grind of pastoral ministry, and share their hard-earned wisdom.

- Tangible, practical, applicable resources (templates, downloads, etc) to simplify your load of administrative tasks.