In 2023, Americans gave more than $500 BILLION to charities.

Considering that any donation over $250 requires a donation acknowledgment letter, that’s a LOT of mail. For pastors or church leaders responsible for creating those church donation letters for tax purposes, the process can be a confusing mess:

- What information needs to be included in these letters?

- What if they donated stuff instead of money?

- What if they received a benefit in return for their donation?

- Is there a minimum amount that I need to write a confirmation letter for?

That’s why I’m here. I’ll answer all these questions and more in this article. (Plus, I’ve included a bundle of sample church donation letters for taxes to get you started.)

Why Are Donation Letters Necessary?

A church contribution letter is a written confirmation from your church that you give to your donors that details their donations made throughout the year. Your donors need this letter to claim their charitable contributions as a deduction on their personal income tax return. Without this letter, if they are audited, the IRS can disallow their church giving.

You can craft your confirmation like a thank you letter. It’s the perfect opportunity to thank your donors which will foster a culture of gratitude. This is a time to check in with your donors and update them on any exciting ministry opportunities the church has been involved in. Taking every opportunity you can to communicate with your donors is going to call attention to the mission of the church and may even encourage more donations.

Legal Requirements For Donation Letters

While there is no specific deadline for donation letters to be issued, in general charities will have them sent out by January 31st in the year following the donation.

So if a donor made a monthly donation throughout 2025, the donation confirmation letter would be sent out by January 31, 2026. It’s important to do this promptly so that your donors have the necessary documentation when they are putting together their tax information for the April 15th deadline.

You are required to provide a donation letter for any one-time donation of cash or gift-in-kind that is more than $250.

If the donation is less than $250, you are not required to issue a confirmation letter. However, I recommend sending out a letter to your donors regardless of the amount. It’s a great way to celebrate generosity.

Just like Jesus, we want to acknowledge the heart behind the donation rather than the size of it.

Luke 21:1-4

You do not have to send a confirmation letter for each donation received. It is acceptable to wait until the end of the year and issue one letter acknowledging all of the donations in the year.

This is likely the most efficient and helpful option not only for you but also for your donors. It’s much easier to keep track of one statement than a whole stack of letters for someone making a weekly donation.

Church Donation Letter Examples/Templates

You have options for your contribution letter, and it mostly depends on the type of donation you receive. All these are covered in this section, as well as some sample letters.

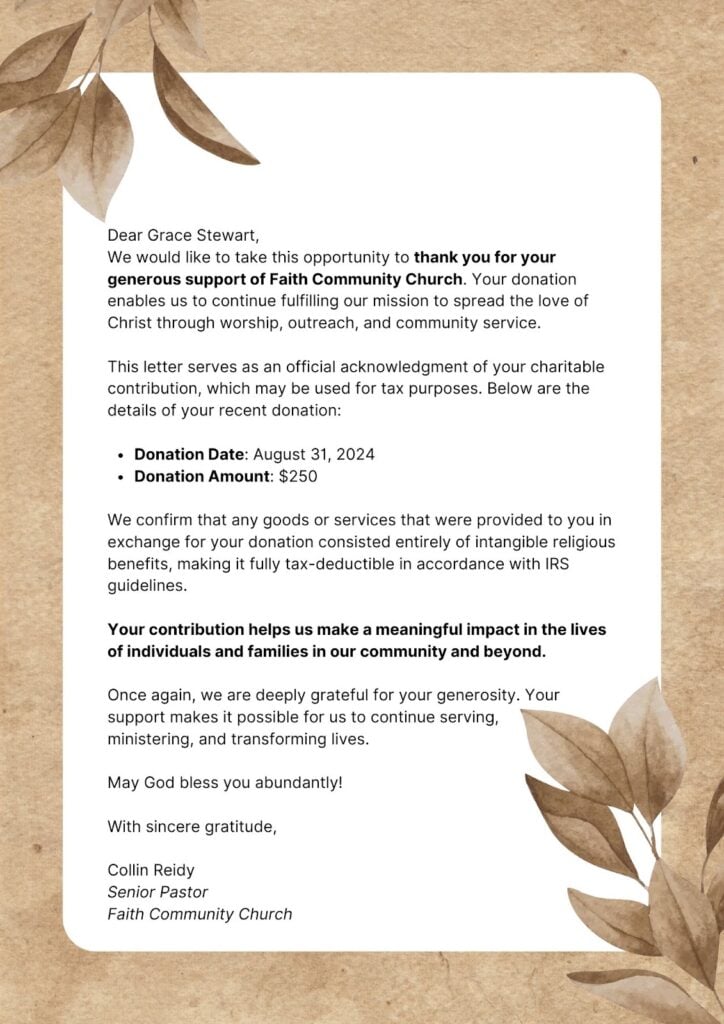

Example #1 - Donation Receipt Letter (Tax-Deductible Acknowledgment Letter)

The main purpose of this letter is to acknowledge a one-time gift or donation made to the church. This letter will ensure the donor has proper documentation when they file their income tax return. You might issue these letters at the end of a big fundraising campaign where you have received a lot of one-time donations for the church.

Example #2 - Annual Contribution Statement

The purpose of this letter is to provide a summary of all the donations made in the past year by the donor. This will be more common in a church setting where you have regular donors who are paying recurring tithes and offerings.

Again, this statement will be used by the donor as proper documentation for the deduction they claim on their income tax return. Typically, this statement is issued annually in January for all the donations made in the previous year.

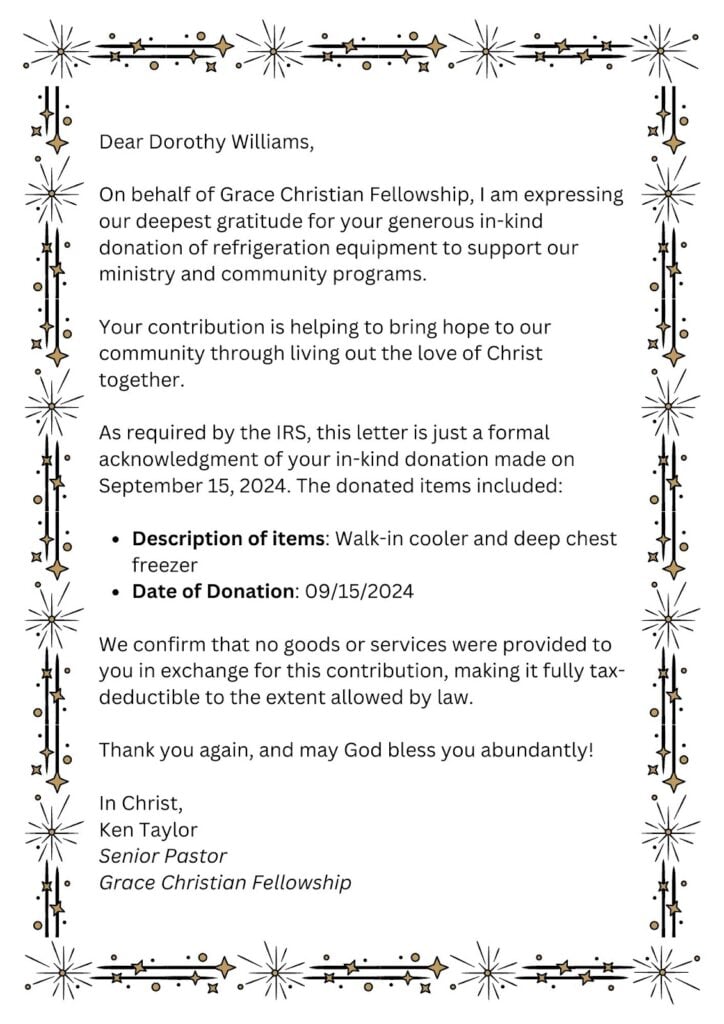

Example #3 - In-Kind Donation Letter

Sometimes you may receive donations that are non-cash property or services. For example, someone might donate furniture or a vehicle. Or they might donate their services; such as graphic design or landscaping services. In this case, you can issue a letter acknowledging the donation. You are required to list the date of donation and the item(s) but you do not assign a monetary value to the donation.

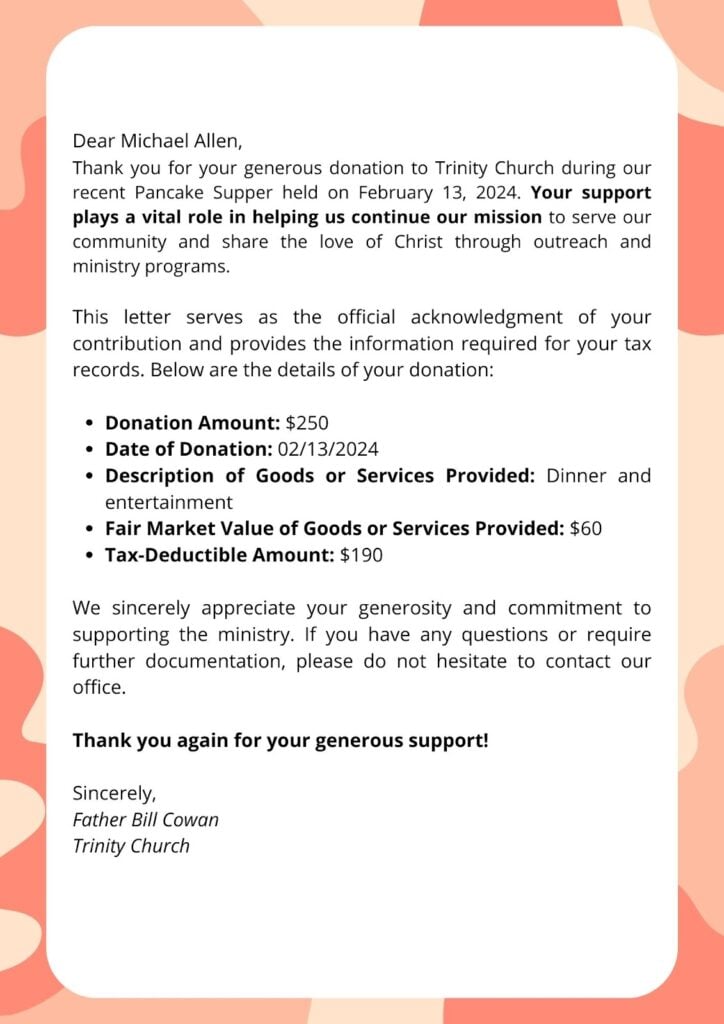

Example #4 - Quid Pro Quo Donation Letter

There may be cases where you receive a donation in exchange for a service or item. When this happens, you can issue a donation confirmation letter for the difference between what was donated and what the donor received in exchange.

An example of this might be when you hold a fundraising event, such as a spaghetti dinner. The tickets you sell might be for $60 each but the estimated cost of the meal is $20. Therefore the donated amount would be $40.

Your letter should include the following:

- Donation amount

- Description of the goods or services provided to the donor,

- An estimate of the fair market value of the goods or services received

Crafting Your Church Donor Letters

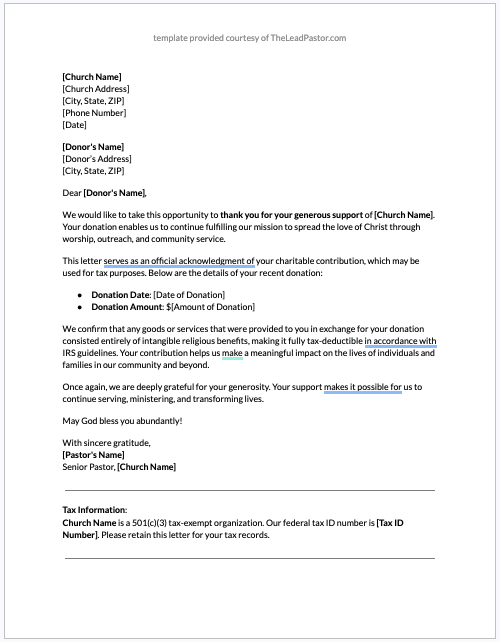

The IRS has specific regulations for your donor letters. Each letter needs to contain the following information:

- Church Name

- Donor Name and contact information

- Donation Amount

- Description (but not value) of non-cash contribution - If you received a gift of property, you need to list this item on the letter but the IRS does not permit you to assign the value of the item.

- Disclosure Statement - one of the following

- No goods or services were provided by the organization in exchange for donations.

- If any goods or services were provided in exchange for the contribution, provide an estimate of that amount, even if it was a token amount.

- State that goods or services, if any, that the organization provided in exchange for the donations were entirely of intangible religious benefits.

Remembe: donation letters are only a small part required of the church to maintain its tax-exempt status. Learn the importance of a church finance report and how this information will help when you go to create your annual church budget.

Your Free Bundle: (Editable) Sample Church Donation Letter for Taxes

I have crafted some letter templates to help you get started. Feel free to download and use these for your purposes. NOTE: Be sure to confirm any financial details with your church accountant or finance professional before sending your letters.

Needing to Dig Deeper?

Check out these resources:

- Clergy Financial: How to Write a Church Donor Acknowledgement Letter

- Kindful.com: What Is A Donation Acknowledgment Letter?

- TurboTax Video: IRS Rules for Charitable Giving

NOTE: Guidelines For Canadian Churches

For churches in Canada, the requirements are a little different. The CRA recommends all receipts be issued before February 28th in the year that follows when the donation was made. According to the CRA, receipts should contain the following information:

- a statement that it is an official receipt for income tax purposes

- the name and address of the charity are on file with the Canada Revenue Agency (CRA)

- a unique serial number

- the registration number issued by the CRA

- the location where the receipt was issued (city, town, municipality)

- the date or year the gift was received

- the date the receipt was issued

- the full name, including the middle initial, and address of the donor

- the amount of the gift

- the amount and description of any advantage received by the donor

- the eligible amount of the gift

- the signature of an individual authorized by the charity to acknowledge gifts

- the name and website address of the CRA

Join Our Email List For More Valuable Insights

Join our growing community of passionate pastors committed to deepening their ministry and walking faithfully in their calling.

Subscribe now and never miss out on the tools and encouragement you need to thrive in your ministry!