Church accounting guidelines are essential for keeping your church’s finances transparent, compliant, and well-organized. Without clear financial systems in place:

- Budgeting becomes inconsistent, making it hard to plan for ministry needs.

- Tax and legal compliance issues can put your church at financial risk.

- Donor trust may decline if giving records aren’t properly managed.

These challenges often arise because churches rely on outdated processes, lack financial expertise, or don’t have the right tools (like Quickbooks) to track income and expenses effectively.

That’s why I’ve put together this ultimate guide to church accounting guidelines—to help you establish solid financial practices, avoid compliance pitfalls, and ensure your church’s financial health. Check out our in-depth analysis and ranking of this year’s best church accounting software tools).

What Is Church Accounting?

Church accounting is the practice of managing a church’s finances, from donations to expenses. Church accounting software simplifies this process by tackling common challenges, such as:

- Tracking and recording tithing according to government regulations accurately.

- Managing and allocating ministry budgets efficiently.

- Maintaining transparency and accountability within the church.

- Integrates with church giving software

Beyond these tasks, accounting software is essential for ensuring effective management of your church records, as well as clear and honest financial practices. If you’re unsure which church accounting software is best for you, check out our article on this year’s very best church accounting software.

Church Accounting Guidelines And Best Practices

Let's explore the essential guidelines and best practices every church should follow to maintain financial integrity.

Keep Detailed Records.

This is crucial for your church. Document every donation, expense, and transaction. Generate regular, clear church financial reports. This will maintain transparency with the congregation and ensure that you have a clear picture of your church's financial activity.

Maintain Clear Budget Lines.

Ensure all your funds are allocated to proper budgets and purposes (e.g., Children's Ministry, Missions, Building funds). This will avoid any confusion and ensure that money is being used as intended.

Conduct Regular Audits.

Conduct regular internal and external audits. This should not be seen as a negative thing but as something that will help catch errors, prevent fraud, and, above all, build trust with your congregation.

Use Church Accounting Software:

Dedicated accounting software for your church will streamline your processes, reduce accounting errors, and save time on administrative tasks.

The Lord detests dishonest scales, but accurate weights find favor with Him

Proverbs 11:1

Accounting Team Saves Dozens of Hours Each Week with Church Accounting Software

Parable Church Accounting, an accounting service specifically for churches, faced significant challenges with manual expense management involving paper receipts, spreadsheets, and manual reconciliations. This process was time-consuming and error-prone, diverting leadership from their mission.

By adopting church accounting guidelines, aided by industry-leading church accounting software, Parable streamlined its accounting processes. The software they chose saved 3-4 hours per week per client (adding up to dozens of hours each week). The biggest time savers?

- Receipt scanning

- Credit card integration

- QuickBooks Online synchronization

The overall administrative burden on their staff was drastically reduced. This allowed their leaders to focus on their core mission, knowing their finances were efficiently managed and compliant with IRS requirements.

Additionally, their accounting software improved accuracy and transparency in financial reporting, making it easier for Parable to manage church budgets and track spending. The software's user-friendly interface and mobile accessibility ensured that staff could submit expenses on the go, further increasing efficiency.

Embracing and implementing church accounting guidelines and utilizing the best financial tools transformed Parable's financial outlook.

Parable's financial management hit a new level, reducing errors and administrative workload while enhancing financial oversight. This shift empowered their leaders to dedicate more time and resources to the work of growing their reach.

What's the Difference Between Church Accounting and Business Accounting?

When it comes to accounting, churches and businesses operate in different worlds. To help clarify things, let's examine some of their basic financial practices and how they differ.

Accountability, not Profitability:

In church accounting, the focus is accountability (of course, having money left over at the end of the month is awesome, but that’s not the objective). Churches must be accountable to the congregation for the use of their donations and/or tithes. They must show that funds are being used according to the church's mission and/or annual plan.

In business accounting, conversely, the primary goal is profitability—tracking income and expenses to maximize profits.

Fund Accounting, not General Ledger:

Churches use fund accounting to track donations and expenses by specific categories (e.g., missions, building fund, youth ministry). This ensures that designated funds are used for their intended purpose, maintaining financial integrity and donor trust.

For example, if a member donates $5,000 to the building fund, those funds must be recorded separately and only spent on building-related expenses—not general church operations.

Unlike businesses that use a general ledger system (which tracks all financial transactions in a single record), churches must manage multiple funds with separate balances.

Practical Tips:

- Reconcile Fund Balances Monthly – Regularly check that fund balances match designated donations to prevent accounting errors.

- Create Dedicated Fund Categories – Establish clear, labeled funds in your accounting system for designated giving.

- Use Restricted and Unrestricted Labels – Clearly define which funds have spending restrictions to avoid misallocation.

Mission, Not Profits:

Churches operate based on a mission to serve their community and fulfill the vision and values that the church and leadership have prayed into. Financial decisions are made in support of the mission, not simply to generate profit. On the other hand, businesses focus on generating profits for the business owner or shareholders.

Tax-Exempt Status:

Churches, like most nonprofit organizations, have tax-exempt status. This means they don't pay federal income tax and can receive tax-deductible donations. Businesses pay taxes on their profits and don’t have those same income and donation incentives.

2025 Best-In-Class Church Accounting Software

My team and I (besides being stellar writers) are pastors and church leaders. We know how crucial the right software is, and how daunting it can be to find it. To that end, we’ve invested in deep research and tested, evaluated and ranked this year’s very best church accounting software. Here’s our shortlist of the top-tier software tools.

Tangible Benefits Of Solid Church Accounting

A robust church accounting method will clarify areas that sometimes feel chaotic. You can say goodbye to the stress of keeping track of scattered tithing envelopes and being able to streamline the financial processes with accurate financial reporting. This will give you more time to focus on what truly matters- serving your congregation and community.

You can say goodbye to the stress of keeping track of scattered tithing envelopes as you simplify financial processes with accurate financial reporting. This will give you more time to focus on what truly matters- serving your congregation and community.

Here are some key benefits to expect when you successfully implement Church Accounting Software:

More Confidence in Your Donors

Generating and maintaining clear, detailed church financial report records (donations, expenses, ministry fund allocations, etc) will build trust and accountability within your congregation. The percentage of your church members who tithe or give can feel confident their tithes are being used effectively and responsibly to support the church's mission and vision.

More Time and Money, Less Stress

Streamlining your financial management systems and processes will save time and reduce your administrative workload.

With the automated reporting and budget tracking features, the financial work will be so efficient that it will allow your staff and volunteers to focus more on ministry and community outreach efforts. This will help strengthen your ability to support your church's mission, which in itself is a huge win!

Compliance and Peace of Mind

Compliance with tax regulations and reporting standards is crucial to any church accounting system. Minimize the risk of errors or penalties. With proper accounting software, you can navigate audits and financial reviews confidently, protecting your church's financial integrity and providing peace of mind for your leaders, volunteers, and church members!

Church accounting software helps you get your church’s bookkeeping done quickly and accurately, so you and your administrative staff can get back to the things that matter most to your ministry.

Karrin Sehmbi, Nerd Wallet

Further, Karrin recommends PowerChurch accounting software because it provides accounting software as well as church management features. To learn more about the importance of church finances, read our article on church financial management. You can also check out our ranked list of industry leaders in the church accounting software industry.

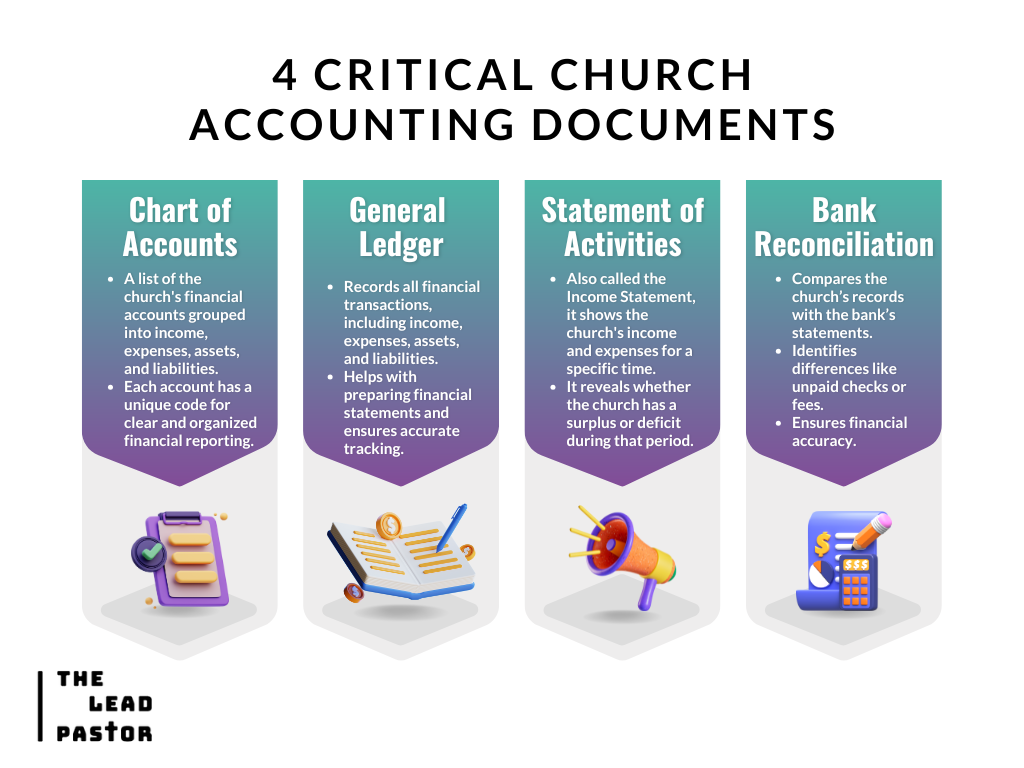

Critical Church Accounting Documents

Understanding the fundamental documents involved in church accounting will help maintain your financial records effectively.

1) Chart of Accounts

The Chart of Accounts is an organized listing of all financial accounts used by the church, categorized into cash flow income, expenses, assets, and liabilities. Each account is assigned a unique code for easy reference, providing clarity and structure to your financial reporting.

2) Statement of Activities

The Statement of Activities, or the Income Statement, details your church's revenue and expenses over a specific period. It provides a snapshot of your financial performance, showing whether your church is operating at a surplus or deficit during that time.

3) General Ledger

The General Ledger is the central repository for all financial transactions. It includes detailed entries for income, expenses, assets, and liabilities, supporting the preparation of financial statements and ensuring comprehensive financial tracking.

4) Bank Reconciliation Statement

The Bank Reconciliation Statement ensures that the church's financial records match the bank statements. It verifies that all transactions the church recorded align with those the bank recorded. This process helps identify discrepancies such as outstanding checks or bank fees, adding a layer of accuracy and error prevention to your financial records.

These documents are essential for maintaining accurate and transparent church accounting practice. Additionally, they provide a layer of accuracy and error prevention to your financial records (NOTE: how long you keep financial records depends on IRS guidelines).

Your Church Accounting ToolBox

There are 3 essential types of software that every church should integrate into its church accounting toolbox.

Tool #1: Church Accounting Software

Church Accounting Software is designed specifically to meet the needs of churches. It will help track donations, manage funds for various ministries and projects, and generate detailed financial reports.

Many smaller churches start out with a generic church accounting software like Quickbooks - and while that's not necessarily a bad thing, there are excellent alternatives to Quickbooks designed specifically for churches. Don't rush into the decision. Take your time, do your research - set yourself up for long term success.

2025's Best Church Accounting Software Tools

Here's my pick of the 5 best software from the 5 tools reviewed.

Tool #2: Church Bookkeeping Software

The right software will help simplify your church's bookkeeping, without question. It will record income and expenses, reconcile bank accounts, and manage budgets. It will also provide a clear and organized view of your church's financial health, which will help facilitate informed decision-making and ensure accurate financial reporting.

2025's Best Church Bookkeeping Software Tools

Here's my pick of the 5 best software from the 5 tools reviewed.

Tool #3: Church Payroll Software

Church payroll software will automate payroll processing, ensuring timely and accurate payment of staff salaries and wages. IT will also automatically calculate deductions for taxes, retirement contributions, and benefits, reducing the risk of errors associated with manual payroll tasks.

2024's Best Church Payroll Software Tools

Here's my pick of the 5 best software from the 5 tools reviewed.

For we are taking pains to do what is right, not only in the eyes of the Lord but also in the eyes of man.

2 Cor 8:21

How To Track Your Church’s Revenue

Tracking your church’s revenue is important; the best church accounting guidelines dictate that each type of revenue be tracked as well. Not only does this ensure accountability, but it will also help with your budgeting and financial reporting. Here are some quick examples of your church's revenue sources and how you can track them.

Tithes & Offerings

While there are many different ways for a church to bring in money, this one is likely the bulk of your church's revenue. To record each contribution accurately, use designated envelopes or electronic giving platforms. Ensure that each donation is entered into your accounting system under the correct category, making it easy to generate giving statements for donors as well!

Grants & Donations

Church grants received from foundations or one-time donations from benefactors can be a significant source of revenue. Track these funds separately from regular tithes and offerings.. (For example, someone donates money towards a new roof.) Document each grant or donation's source, purpose, and conditions, and report on the fund spending.

Fundraising

Events such as bake sales, charity auctions, and special events can often require a bit more tracking. Record the income from each event under a specific fundraising category. Keep detailed records of the revenue and expenses related to the fundraising efforts to measure the accurate profits.

Special Events/Building Rentals

Track revenue from special events such as weddings, concerts, or rentals separately. This should be part of your church facility management strategy. Create specific accounts for each type of event to monitor its financial performance. Record all associated fees, charges, and down payments accurately to clearly show how these activities contribute to overall church revenue.

Revenue Diversification

These are just a few of the many ways that churches can make money, but there is so much more you can do. Diversifying your revenue streams is an effective way to bring in more money for the church. Get creative and look at ways your church can meet the needs of your congregation or the greater community.

Can you leverage the need into a source of revenue for the church? Consider some of the following for your church community:

- Open a thrift store to provide affordable clothing to the community.

- Run a coffee shop where people can gather for fellowship and encouragement.

- Provide pastoral counselling or summer camps and retreats.

- Offer preschool or daycare services at your church during the week.

How To Maintain Regulatory And Tax Compliance

Navigating regulatory and tax requirements is crucial for your church's financial health and legal standing. Having a dedicated church finance committee can greatly aid in overseeing these responsibilities and ensuring compliance. By following some key practices, you can ensure your church remains compliant and avoids unnecessary penalties. Here are three essential recommendations to help you maintain regulatory and tax compliance.

Keep Detailed Records

Maintain detailed and accurate records of all financial transactions and cash flow, including donations, expenses, payroll, and grants. Proper documentation of any financial data helps you stay prepared for audits and will help you provide evidence of compliance with regulatory and tax guidelines.

Understand Tax-Exempt Status Requirements

Always ensure that your church meets the requirements for maintaining its tax-exempt status. Familiarize yourself with federal guidelines and any local regulations that apply. You dont want any surprises! Regularly review your church activities and financial practices to ensure they align with compliance regulations.

File Required Reports and Tax Forms on Time

Stay on top of all filing deadlines for tax returns and submitting church financial reports. Use a compliance calendar to track important dates and to set reminders. You want to avoid any late penalties and make sure your church remains in good standing with the IRS and tax authorities!

Suppose one of you wants to build a tower. Won't you first sit down and estimate the cost to see if you have enough money to cover it?

Luke 14:28

IRS Compliance

Though your church is likely exempt from paying taxes, there are still IRS regulations that your church is required to follow. Here are some examples to be aware of:

- Form 990 (or 990-EZ or 990-N): Churches that are not exempt from filing must submit an annual return to report their financial activities.

- Form W-2: Use this form to report wages paid to employees of the church, along with the taxes withheld, such as income, Social Security, and Medicare taxes.

- Form 1099: Report payments made to independent contractors, freelancers, or non-employees. If you pay $600 or more to a contractor, you need to issue a 1099-NEC.

- Form 941/944: This form is used to report income tax, Social Security, and Medicare taxes withheld from employees' paychecks. This form is typically filed quarterly but may be filed annually in some cases.

- Form 990-T: If your church earns income from unrelated business activities, you may need to file this form to report and pay taxes on that income.

Be aware of these forms to ensure the church complies with tax regulations and avoids penalties.

Align with Non-profit Standards

These guidelines will follow Generally Accepted Accounting Principles (GAAP) such as:

- Consistency: You must consistently apply the same accounting methods (e.g., cash or accrual) over time for reliable and comparable financial statements.

- Full Disclosure: Financial reports should include all necessary details, like donor restrictions on funds or outstanding liabilities, to ensure transparency.

- Matching: Expenses are recorded in the same period as the related revenue.

- Revenue Recognition: Contributions, tithes, or grants should be recorded when they are received or committed, depending on the accounting method used.

- Follow Non-Profit Specific Guidelines: Churches must follow non-profit-specific guidelines, including accurate reporting of restricted and unrestricted funds, and clear expense allocations for ministries, day-to-day expenses, and fundraising.

In-House vs Outsourced Accountant

Choosing between hiring an in-house accountant or outsourcing your church’s accounting depends on your budget, staff capacity, and financial complexity. Here's a quick comparison:

| In-House Accountant | Outsourced Accountant | |

|---|---|---|

| Cost | Higher (salary, benefits) | Lower (flat fee or hourly) |

| Expertise | Limited to one person’s skills | Access to specialized professionals |

| Control | Full oversight of financial processes | Less direct control but professional oversight |

| Scalability | May require hiring more staff as finances grow | Easily scales with church needs |

| Compliance | Dependent on individual knowledge | Often includes legal and tax compliance expertise |

Smaller churches often benefit from outsourcing, while larger churches may prefer the control of an in-house accountant. Assess your church’s needs to determine the best fit.

How to Delegate The Accounting Responsibilities

Delegating accounting tasks ensures financial accuracy while freeing up time for ministry. Here are five key ways to do it effectively:

- Define Clear Roles – Assign specific responsibilities like budgeting, reporting, and donor tracking to designated staff or volunteers.

- Use Accounting Software – Implement the best church accounting tools to simplify financial management and reduce human error.

- Set Approval Processes – Establish a system where major financial decisions require multiple approvals to enhance accountability.

- Schedule Regular Check-Ins – Hold monthly or quarterly meetings to review reports and ensure everything stays on track.

- Consider Professional Support – If finances become too complex, outsource payroll, tax filings, or full accounting services.

A well-structured delegation plan keeps your church’s finances organized while reducing the burden on any one person.

How To Create A Church Operating Budget

Creating a church operating budget is critical for effective stewardship and financial health. As Proverbs 21:5 says, “The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.”

If you haven't created a church budget before or if it seems daunting, here are five church accounting guidelines to guide you through the budget development process:

1. Identify Income Sources

Start by listing all potential income sources, including tithes and offerings, fundraisers, and facility rentals. Estimate the expected amounts based on historical data and current trends.

2. List All Expenses

Create a comprehensive list of all anticipated expenses, such as staff salaries, utilities, maintenance, ministry activities, and outreach programs. Include both fixed and variable costs to ensure complete coverage.

3. Prioritize Spending

Align your expenses with your church’s needs, missions, and goals. Work with church leaders to prioritize essential expenses like staff salaries and building maintenance, followed by ministry and outreach programs. Allocate funds based on importance and necessity.

4. Set Financial Goals

Establish financial goals for the year, such as saving for future projects or paying down debt. Include these goals in your budget to ensure you plan for current operations and future growth.

5. Monitor and Adjust Regularly

Regularly review your budget to track actual income and expenses against your projections. Make adjustments as needed to stay on track and address unexpected changes. Ongoing monitoring ensures your budget remains an effective tool for your church's financial stewardship.

By following these steps, you can create a solid operating budget that supports your church’s mission and ensures financial health.

Final Thoughts:

Church finances should never be a guessing game. By following church accounting guidelines and tools, managing your church's finances brings many benefits and can be straightforward and transparent. Implementing best practices in church accounting ensures faithful stewardship of the resources entrusted to you, promoting trust and accountability within your congregation.

For US churches, refer to this IRS Guide to Compliance for Charities.

From detailed record-keeping and clear budget lines to regular audits and the use of dedicated accounting software, each step helps maintain financial integrity. Embrace these practices, and let your church's financial management be a testament to diligent and faithful stewardship.

Join The Lead Pastor Email Newsletter

Stay informed and get more tips on managing your church’s finances by joining our newsletter! Sign up today for valuable insights, best practices, and resources to help your church thrive!