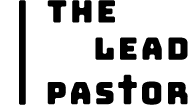

A gift acceptance policy is risk management: It protects your nonprofit from burdensome or non-mission-aligned donations (like real estate, crypto, or heavily restricted gifts).

Every gift should be reviewed — not just accepted: Non-cash, high-value, or conditional gifts may carry legal, financial, or operational risks that outweigh the benefit.

Define who decides what gifts are appropriate, and when: Set clear thresholds for which gifts staff can accept, and which require board or senior leader approval.

A gift acceptance policy, while often overlooked, can save your church a ton of headache. When someone offers your organization an unusual gift (a building, a piece of land, Bitcoin, etc) do you know what to say? Without a clear policy, most nonprofits are forced to scramble:

- Leaders make snap decisions under pressure.

- Hours get lost untangling legal, tax, or reputational headaches.

- Trust with donors and members erodes when decisions seem inconsistent or unfair.

The problem is NOT that nonprofits or boards don’t care about stewardship. It’s that many leaders inherit systems never built for today’s complexities — especially when gifts come with strings attached, hidden costs, or public scrutiny.

What a Gift Acceptance Policy Is & Why You Might Need One

A gift acceptance policy is a simple but powerful tool. It outlines what kinds of gifts your church will—and won’t—accept. It clarifies who makes those decisions. And it helps your pastoral team respond with wisdom when an unexpected donation shows up. For pastors, this isn't just a policy issue—it's a matter of spiritual and organizational integrity.

Whether you're leading a small rural congregation or a large urban campus, setting expectations early helps everyone involved.

There are several reasons your church might need a policy like this:

- Values alignment: Not every gift aligns with your ministry vision.

- Risk management: Some gifts carry legal baggage or ethical complications.

- Clear boundaries: A defined policy helps avoid awkward or pressured conversations.

- Operational efficiency: It protects your team from gifts that demand more upkeep than they’re worth.

- IRS compliance: The IRS requires nonprofits (including churches) to file Form 990 Schedule M for gifts over $25,000.

- Fundraising consistency: A clear policy strengthens your overall fundraising strategy by providing consistency for staff and prospective donors.

- Planned giving clarity: It helps structure and screen long-term commitments like bequests or charitable trusts.

- Estate planning alignment: A policy ensures you can receive gifts through estate channels responsibly.

Want to align this with your overall stewardship structure? Start with your church budget and grant strategy. Looking to fund church repairs through grants? That’s another reason to build clarity into your policies!

Four Sample Gift Acceptance Policies to Customize

Every church context is different. Below are four templates designed with ministry realities in mind. Also relevant: building trust through your church’s online presence.

Sample Policy for Small Rural Churches

This could apply to churches under 100 members or with operating budgets under $250,000

Policy:

- The church will accept only cash, checks, credit card, and online donations unless reviewed by the board.

- Any gift or non-cash item of $10,000 value or more must be reviewed by the board.

- Real estate, vehicles, or cryptocurrency donations will not be accepted unless legal counsel verifies the gift poses no legal or financial burden.

- Donors must sign a gift agreement for any restricted or designated gifts.

- Gifts of tangible personal property may only be accepted if they directly support ministry operations or can be sold.

- Matching gifts are encouraged and tracked through the church finance team.

- Donated property must be reviewed for hidden costs like property taxes or maintenance needs.

Example Language:

"Non-cash gifts such as equipment or property will only be accepted with prior approval from the board and, if necessary, outside legal or financial counsel."

Sample Gift Policy for Multisite or Mega-Churches

This is geared towards Churches with multiple campuses and/or $1M+ in annual giving

Policy:

- Establish a standing Gift Acceptance Committee (GAC), composed of executive leadership, a board rep, and a legal/financial advisor.

- Routine gifts under $15,000 (e.g. annual pledges, gifts of cash) may be accepted by finance staff.

- Complex gifts (e.g. appreciated securities, restricted funds over $25,000, gifts of real property, or business interests and partnerships) must be reviewed by the GAC.

- Written procedures must exist for:

- Naming rights

- Donor-advised funds

- High-risk assets

- Charitable remainder trusts and charitable lead trusts

- Acceptance of the gift timeline and form

- Closely held securities, mutual funds, or major gifts over $100,000 require legal review.

Example Language:

"No real estate shall be accepted without a Phase I environmental assessment, appraisal of fair market value, and written legal opinion."

Sample Gift Acceptance Policy for Urban Church Plants

Written for Churches in the first 5 years of their planting, or churches in urban/multiethnic/digital contexts

Policy Summary:

- Accept in-kind donations such as tech, services, or rental space after value is assessed and approved by the board.

- Designate a gift review team (pastor + 1 board member) to handle nontraditional gifts.

- Cryptocurrency donations will be capped at $5,000 per year and must be converted immediately upon receipt.

- Public alignment with the church's values is required for all business-related or branded gifts.

- Bequests and life insurance policies may be accepted with prior board review.

- Such gifts must reflect the donor’s intent and fall within ministry priorities.

Example Language:

"We reserve the right to decline any gift that may compromise the theological clarity or public witness of the church."

Sample Gift Policy for Historic or Legacy Churches

This policy could apply to Churches with endowments, large bequests, or over 50 years in ministry

Policy Summary:

- All legacy gifts (wills, trusts, named donations) must be reviewed for mission alignment.

- Establish a policy for re-evaluating the purpose of long-standing restricted gifts every 10 years.

- Board must approve any reallocation of legacy funds that no longer align with ministry focus.

- Real estate or artifact donations must come with a maintenance/endowment fund or they will be declined.

- Any conflict of interest involving board members and prospective donors must be disclosed and mitigated.

- Gifts must be accepted in accordance with applicable laws and documented by law.

- Life estates and charitable gift annuities are reviewed by legal counsel before acceptance.

Example Language:

"The church reserves the right to respectfully decline any legacy gift that no longer supports the current or future mission of the congregation."

Process for Evaluating Gifts

Your church needs more than a list of approved items. I highly recommend putting a simple process in place for assessing each potential gift. For example:

- Initial Gift Inquiry: Prospective donors submit intent to give via a standard Gift Proposal Form. This form includes the gift type, estimated fair market value, any restrictions, and timing.

- Preliminary Screening: Senior staff reviews for immediate red flags. If it’s a routine cash or credit card donation, it may be approved on the spot. Non-cash or high-value gifts move to the next phase.

- Gift Review Committee Evaluation: The designated committee (pastor, finance chair, legal advisor, and where applicable, a member of the executive committee or executive director) meets to assess risk across financial, legal, operational, and reputational dimensions.

- Due Diligence: This may include legal review, environmental assessments (for real property), liquidation plans for non-liquid assets, or consulting your church’s insurance provider.

- Decision & Documentation: Committee makes a recommendation. Final approval may rest with the executive pastor or board. A formal gift agreement is signed and recorded.

- Acknowledgment & Stewardship: A thank-you letter, tax receipt, and donor care follow-up are issued. The donor’s gift is tracked for compliance with any restrictions.

A process like this one ensures transparency, protects your team from reactive decisions, and creates a paper trail that honors both the acceptance of the gift and the donor's intent.

Who Should Be Involved?

Leverage your church finance committee here. They definitely need to be part of the filter. In general, though, evaluation should include multiple voices:

- Final say often rests with the board of elders, executive pastor, or designated executive committee.

- Legal counsel should be involved for real estate or restricted gifts.

- Set thresholds (e.g., $50,000) to trigger formal board review.

Which Types of Gifts Should Be Covered?

This policy isn't just about cash. Be clear about other assets too:

- Gifts of cash

- Real estate / gifts of real estate / gifts of real property

- Stocks, marketable securities, mutual funds, and closely held securities

- In-kind gifts (equipment, vehicles, services)

- Designated/restricted gifts

- Cryptocurrency

- Complex assets (e.g., private business interests, charitable trusts, partnerships)

- Tangible personal property

- Life insurance policies and gifts of life insurance

- Bequests, planned gifts, and estate gifts

- Matching gifts

- Outright gifts

- Life estates and charitable gift annuities

What Happens When A Special Gift Can’t Be Accepted?

Here’s where many pastors freeze. You can say no without harming the relationship. Your gift acceptance policy is your ally here. It allows you to:

- Gently explain why certain gifts can’t be received.

- Clarify that the issue is stewardship, not rejection.

- Point to a published (or at least referenced) policy.

- Show that decisions are made consistently, by law, and in alignment with donor expectations.

Gift Acceptance Policy FAQs for Nonprofits (with Churches in Mind)

1. Does a small church really need a formal gift acceptance policy?

Yes. Even neighborhood churches face risk, and a policy helps protect your church from gifts that could cause legal or financial trouble. It’s about shepherding your resources well and giving your leaders the confidence to handle unusual situations—not just adding bureaucracy.

2. Can we refuse a gift without damaging the donor relationship?

Yes. Boundaries with gratitude go a long way, and a pre-written policy makes the “why” clear. When you explain your reasoning with care and point to a consistent policy, most donors will understand and respect your decision.

3. What types of gifts are most likely to create problems?

High-risk gifts include real estate, restricted funds, crypto, art, vehicles, and business ownership. Anything with strings attached or unusual requirements deserves extra scrutiny. These gifts can come with hidden costs or obligations that outweigh their benefit.

4. Who should evaluate unusual or high-value gifts?

Form a Gift Acceptance Committee with board members, senior leaders, and advisors. Having a group ensures decisions are thoughtful and balanced, rather than resting on one person’s shoulders. This approach also creates accountability and consistency in your process.

5. How often should we update our gift acceptance policy?

Every two years is wise, so your policy stays relevant as laws and giving trends change. It’s also smart to revisit your policy whenever you encounter a new type of gift or major shift in your ministry. Regular updates help keep your church protected and prepared.

Feeling Alone in Church Leadership?

Subscribe to The Lead Pastor newsletter for simple, actionable resources that help you navigate the challenges of ministry leadership—delivered right when you need them.

We’d love to have you.