Use your church attendance and budget to benchmark pay: Compare salary ranges for churches your size and income level.

Include pastoral housing allowance in total compensation: This tax-advantaged benefit boosts take-home pay without extra cost.

Re-evaluate staff pay structure every 1–2 years: Regular reviews help keep salaries fair and competitive.

Clarify job benefits package in writing with your board: Avoid confusion by documenting all salary and perks upfront.

Pastoral salaries vary widely across the United States and the pay scale typically fluctuates according to the size of the church. The U.S. Bureau of Labor Statistics reports the median salary for clergy is $58,920 as of May 2024, but a pastor salary will vary widely depending on denomination, church size, and geography.

Planning for and budgeting for a pastor’s salary is one step in the overall financial strategy. Good church accounting software will help you manage the finances and keep things organized.

So how much should a pastor make?

The answer is not as clear cut as you may like it to be, but there are some factors to consider that I will cover here.

The best approach to determining a pastor’s salary should start with making sure they are well cared for. A pastor’s pay must be commensurate with their role, level of experience, and the responsibility they carry. Bottom line, the guiding principles in deciding a pastor’s salary should remain consistent: generosity, sustainability, and stewardship.

Churches should not try to keep their pastors poor, and should not help them get rich.

John Piper, DesiringGod.org

What’s the Average Pastor Salary in the U.S.?

The U.S. Census Bureau categorizes household income into several brackets, with the middle-income range generally falling between $58,021 and $94,000 annually.

- Lower class: below or equal to $30,000

- Lower-middle class: $30,001 – $58,020

- Middle class: $58,021 – $94,000

- Upper-middle class: $94,001 – $153,000

- Upper class: over $153,000

Within this framework, most pastors in the United States fall into the lower-middle to middle-income class. These salaries often reflect the size and financial capacity of their congregations. Only about 10% of pastors receive a salary that places them in the upper-middle-class bracket.

Salaries represent a significant portion of a church’s annual budget, so careful planning is essential. When drafting your budget, it’s important to consider a range of factors, including the size of your congregation and the number of staff members you employ. In addition to the pastor’s salary, you may need to account for administrative and managerial staff. Managing payroll can be complex, but church payroll software can simplify the process and reduce stress.

How much SHOULD pastors be paid?

Mike Winger, apologist and founder of Bible Thinker, addresses this controversial question, showing scriptural support for fair compensation for those who teach and shepherd the church today.

Average Pastor Salary by Church Size

Pastor salaries often reflect the size of the congregation, with larger churches typically able to offer higher compensation. As churches grow, tools like church giving software become increasingly helpful for managing tithes, offerings, and financial records.

The variation in salary is influenced not only by budget but also by the complexity and demands of leading a larger organization.

While the primary goal of church growth is to reach people for Christ, an added benefit is greater financial stability, which can lead to more sustainable support for pastoral staff. Many church growth strategies naturally emphasize outreach and engagement as key ways to expand both spiritual and practical impact.

Pastoral Salary Ranges by Weekly Attendance

| Church Size | Average Pastor Salary | Notes |

|---|---|---|

| ≤50 | $0–$40,000 | In practice, many churches this size cannot support full-time salary. They are often part-time or bi-vocational. [Lifeway Research] |

| 51–100 | $40,000–60,000 | Smaller churches in this bracket might still be below national pastor averages. Benefits (like health insurance) are uncommon or limited at this size. [GuideStone] |

| 101–250 | $60,000–80,000 | Some churches approach the national clergy median, ~$59k [vancopayments.com] at the lower end, while those closer to 250 attendees pay toward the upper end. Some benefits included [ChurchSalary.com]. |

| 251–500 | $80,000–100,000 | Pastors of this size church often earn in the high five figures. It’s not unusual to see $80k–$100k total compensation (salary + housing) in a 300-member church. Full benefits typically included [Vanderbloemen]. |

| 500+ | $100,000–$160,000+ | High range – often six figures. Senior pastors of very large churches command the highest salaries. May include sabbaticals, bonuses [MinistryPay.com]. |

Salary Differences Between Senior, Associate, and Youth Pastors

Church staff salary often varies based on role, responsibilities, and experience.

The senior pastor’s salary is typically the highest, with an average range of $60,000 to $100,000 [Lifeway/GuideStone 2022 Survey], depending largely on the size and location of the church. Their compensation reflects the leadership demands of overseeing the entire congregation, managing staff, preaching regularly, and setting the overall vision and direction of the church.

In addition to Senior Pastor, salaries vary depending on the role:

- Executive pastors often earn the second-highest salary after the senior/lead pastor.

- Associate pastors, who support the senior pastor and often lead specific ministries like discipleship, worship, or pastoral care, generally earn between $45,000 and $60,000 [ChurchSalary.com].

- Youth pastors, whose focus is on ministering to teenagers and young adults, typically receive salaries in the $35,000 to $50,000 range [Vanderbloemen Research 2023].

Each role is vital to the church’s health and growth, but they often come with more limited budgets. When determining salaries, it’s important not to adopt a corporate or worldly mindset that equates income with status or success.

The goal should be to provide a reasonable, context-sensitive wage that allows pastors to live simply and focus on ministry without financial stress.

As John Piper emphasizes below, churches should avoid extremes—neither exploiting nor overindulging their leaders.

Denominational Differences in Church Compensation

| Denomination | Avg. Salary (Senior Pastor) | Notes |

| Southern Baptist | $60k–95k | Smaller churches may pay under $40k and are often part-time or bi-vocational. Many start receiving benefits at 250+ congregation size. [GuideStone SBC Compensation Survey] |

| United Methodist | $48k–100k | Has minimums by conference and often includes a parsonage or housing allowance. [UMC Conference Guidelines 2022] |

| Catholic | ~$33k | Catholic priest compensation does not substantially increase with a slightly larger congregation – it remains a standard stipend with living expenses covered. [Catholic Diocese of Cleveland and other diocesan reports] |

Salary Ranges by Annual Church Budget

Trends for Growing Churches (50–500 members)

In growing churches, as attendance increases—particularly between the 100 to 250-member mark [Vanco Payments]—churches typically begin raising pastoral salaries to reflect added responsibilities and greater financial stability.

Once a church surpasses 250 regular attendees, many begin to offer additional benefits such as healthcare, housing allowances, and retirement plans [ChurchTrac Report]. These shifts not only help retain quality leadership but also reflect a maturing organizational structure that supports long-term ministry sustainability.

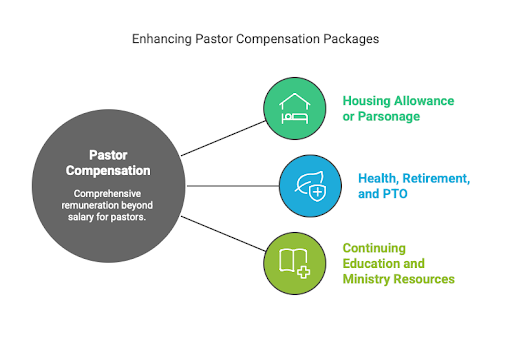

Bonus & Benefits: What Other Elements Are Included?

There is more to remuneration than straight money, and a lot of value can be added to a pastor’s compensation package through additional bonuses and benefits. This is something to keep in mind if your church is short on cash flow but has other assets (eg, a house) and still wants to show honor and support to your pastors.

Housing Allowance and Parsonage

A significant portion of a pastor’s compensation can be designated as a housing allowance—up to 50%—which is tax-exempt under IRS guidelines [IRS Publication 517]. This benefit allows pastors to exclude that portion of their income from federal income tax as long as it is used for eligible housing expenses.

Alternatively, some churches provide a parsonage—a church-owned home—for the pastor and family to live in. Both options are valuable tools that churches can use to support their pastors financially while maximizing tax efficiency.

Health, Retirement, and PTO

As I mentioned earlier, health and retirement benefits become more common after your congregation reaches the 250-member mark [ChurchSalary.com]. Adding these benefits helps to retain good employees long-term and shows you care for your pastors and their families’ well-being.

Some common packages include health insurance, matching retirement contributions, such as 401(k)/403(b), and 3-4 weeks paid time off (PTO).

Continuing Education and Ministry Resources

Additional benefits might include continuing education funds, sabbatical leave policies, or professional development stipends, especially in churches that prioritize leadership development and staff sustainability [Vanderbloemen].

Key Factors That Impact Pastor Pay

Many of these factors reflect not only economic realities but also the varied ways congregations seek to care for their pastors based on local resources and needs.

Church Location (Urban vs Rural)

Several key factors influence how much a pastor is paid, with church location being one of the most significant. Urban and suburban churches typically offer salaries that are 10–25% higher than those in rural areas, largely due to the higher cost of living in metropolitan regions [BLS Regional Data, Vanderbloemen 2023].

In contrast, rural churches often compensate for lower salaries by offering housing, such as a parsonage or a more generous housing allowance [Lifeway].

Cost of Living and Local Factors

When your church is planning financially, you will need to consider the cost of living in your area. Similar to urban vs. rural pastoral positions, the Cost of Living (COL) index will differ by region [Source: BLS COLA Index].

Again, housing costs vary across the country. Someone who is pastoring in a larger city like San Diego, CA, or Miami, FL, will need a higher salary to support their family than will a pastor in Fort Wayne, IN, or Wichita, KS.

Full-Time vs Part-Time Roles

In many churches with fewer than 100 attendees, it’s common to employ part-time or bi-vocational pastors—those who work an additional job outside of ministry to support their families [Lifeway]. This is often a practical necessity due to limited budgets in smaller congregations.

Full-time pastoral roles, with more sustainable pay, typically begin to appear once a church surpasses the 100-member threshold [JustChurchJobs]. At that point, churches often have the resources to support a full-time salary, allowing pastors to devote their full attention to ministry.

Education and Experience

Pastors who hold a Master of Divinity (MDiv) or have over 10+ years of experience in the ministry often earn 10–20% more than their less-experienced or less-formally educated counterparts [GuideStone].

Additionally, ordained pastors or those who have earned additional credentials typically receive higher salaries compared to lay or unordained leaders [UMC Guidelines].

Other Benefits included

When evaluating a pastor’s total compensation, it’s important to factor in the value of additional benefits beyond salary. If these benefits are minimal or absent, the base salary should be adjusted upward to ensure fair and livable compensation.

A well-rounded benefits package not only supports the pastor’s well-being but also reflects a church’s commitment to long-term ministry health and sustainability.

Join TheLeadPastor.com’s Newsletter

Want more insights like this? Join our newsletter for practical tools delivered straight to your inbox! You’ll receive expert tips and encouragement to support pastors and church leaders like you.

Pastor Salary Research Cited:

- U.S. Bureau of Labor Statistics, Clergy Wages - https://www.bls.gov/oes/current/oes212011.htm

- BLS Regional Data - https://www.bls.gov/regions/home.htm

- BLS Cost of Living Index - https://www.bls.gov/data/

- IRS Publication 517 - https://www.irs.gov/publications/p517

- GuideStone SBC Compensation Survey - https://www.guidestone.org/CompensationPlanning

- Lifeway Compensation Study Tool -https://compensationsurvey.lifeway.com/

- JustChurchJobs Salary Guide - https://justchurchjobs.com/resources/pastor-salary-guide

- Ministry Designs - https://ministrydesigns.com/pastors-average-salary/

- Vanco Payments - https://www.vancopayments.com/egiving/blog/average-pastor-salary-by-church-size

- ChurchTrac - https://www.churchtrac.com/articles/pastor-salary-by-church-size

- ChurchSalary.com - https://www.churchsalary.com/

- Vanderbloemen - https://www.vanderbloemen.com/

- Lifeway Research - https://research.lifeway.com/

- GuideStone Financial Resources - https://www.guidestone.org/

- MinistryPay.com - https://ministrypay.com/