<Cue Mission Impossible Music:> Your mission, Pastor, should you choose to accept it, is to navigate your church chart of accounts to draft a financial report for the finance committee budget meeting... As always, should you or any of your team be caught or killed (insert church-appropriate equivalent here), then leadership will disavow any knowledge of your actions. This tape will self-destruct in ten seconds. Good luck.

Ok, so navigating your church chart accounts isn’t exactly Mission Impossible, but it can be pretty darn tough without quality accounting software. If you’re a pastor who is new to church financial management, or you need help setting up a chart of accounts so your church bookkeeping and financial reporting don’t seem so impossible each month, keep reading:

What Is A Church Chart Of Accounts?

A chart of accounts (COA) is a list of all the accounts that a church will use in recording their transactions into the general ledger. This list is used to organize the data into a format that is readable and makes sense for reporting purposes. The COA is usually divided into 5 categories: assets, liabilities, equity, revenue, and expenses.

A nonprofit chart of accounts differs from a regular business chart of accounts primarily in how it reflects the specific financial activities and reporting requirements of a church. While the basic accounting principles remain the same, churches have unique needs related to tracking funds, donations, and program expenses that aren't typically present in a for-profit business.

The following are some differences you will see on a church chart of accounts:

- Fund accounting. Churches are required to use fund accounting to ensure that the donations are being used for the purposes they were intended for. You will see different funds listed in the chart of accounts, such as general fund, mission fund, or building fund.

- Sources of revenue. Churches don’t make sales or service income. Instead, your revenue account might be listed as tithes or donations and you might also see accounts such as grants or fundraising income.

- Expense categories. The expenses for your church will likely fall under specific ministry teams. So instead of reporting the cost of goods sold and overhead costs, you might categorize your expenses into categories such as youth ministry and worship/Audio-visual expenses.

- Tax considerations. Because of the church’s tax-exempt status, you won’t need to record income tax payable or the provision for income tax. However, there may be other tax accounts needed, perhaps if you qualify for any tax rebates.

Why Is A Church Chart Of Accounts Important?

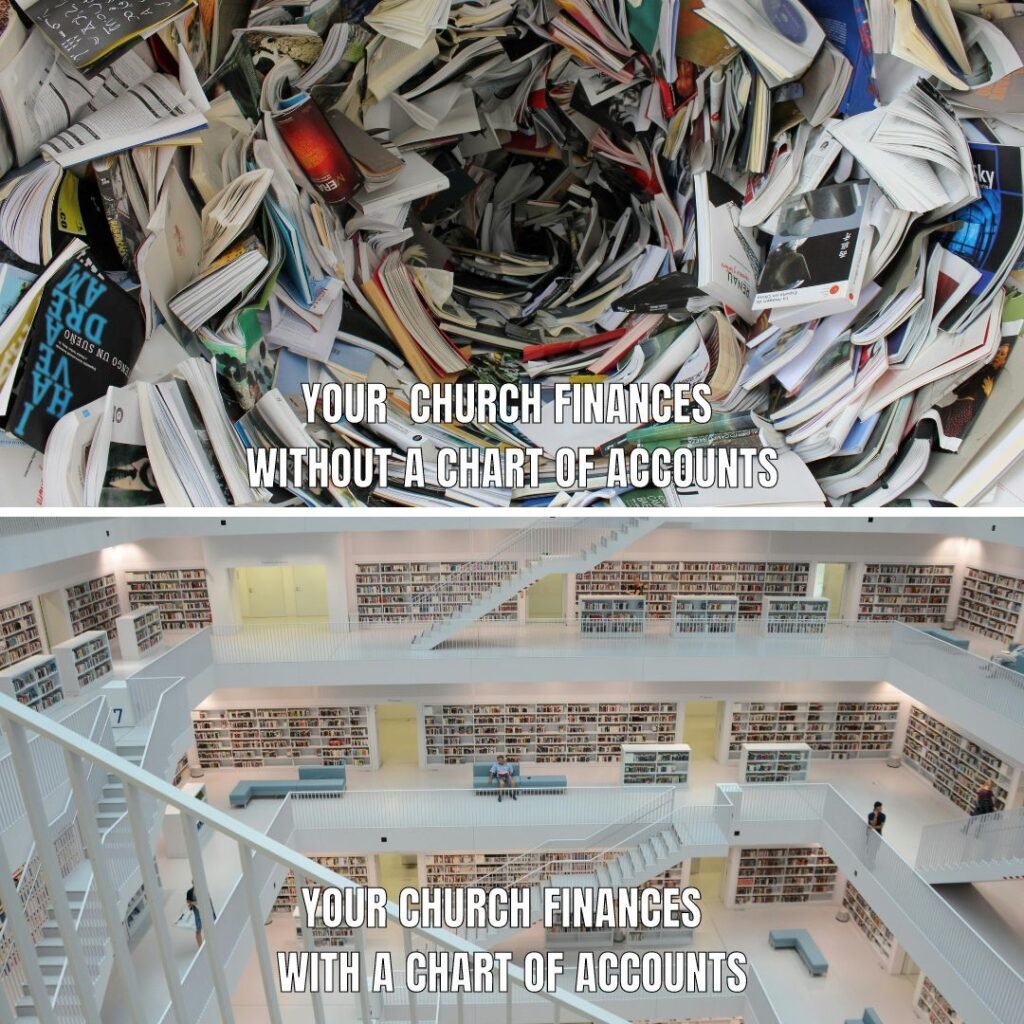

The COA provides the building blocks for setting up the structure in your church accounting system. It is a necessary part of every church’s financial toolbox. Without it, you won’t have any way of understanding the financial state of the church, and finding anything would be time-consuming and frustrating. If you don’t have a chart of accounts your financial data will look something like this…

…Or it can look like this (above). Ahh, that’s better. When I look at the church finances, I want to be able to see where everything is without having to go diving through mountains of data.

Tracking and reporting the finances of the church is required for multiple audiences, from your church finance committee to the IRS to the members of your church. You need to be able to quickly and easily generate reporting data. Your chart of accounts will help you accomplish that.

I have found the best way to go about this is to work alongside our amazing church finance committee. They are the ones who have been put in charge of overseeing the management of the church’s finances, so bring them in on the conversation and use their expertise and experience to your advantage for setting up your chart of accounts.

Here are the benefits of an organized and well-structured chart of accounts:

- Organized Financial Data. Your financial transactions will be organized into an accurate system that makes it easy to find the information you need.

- Improved Financial Reporting. You will be able to generate accurate and informative financial statements, such as income statements and balance sheets. You will have a better idea of the health of the church’s financial position.

- Compliance and Transparency. Compliance with federal and state tax regulations will be tracked effectively. For churches, the use of restricted and unrestricted funds will be properly reported.

- Efficient Auditing and Reconciliation. The audit process is simplified because auditors will be able to locate specific transactions and fund balances. It will also streamline bank reconciliations, payroll reconciliations, and other financial reviews by providing a clear framework for tracking all transactions.

How To Set Up A Church Chart Of Accounts

Every Chart of Accounts is different, but they will all follow this basic structure. Follow these principles and you will have an organized and easy-to-use COA.

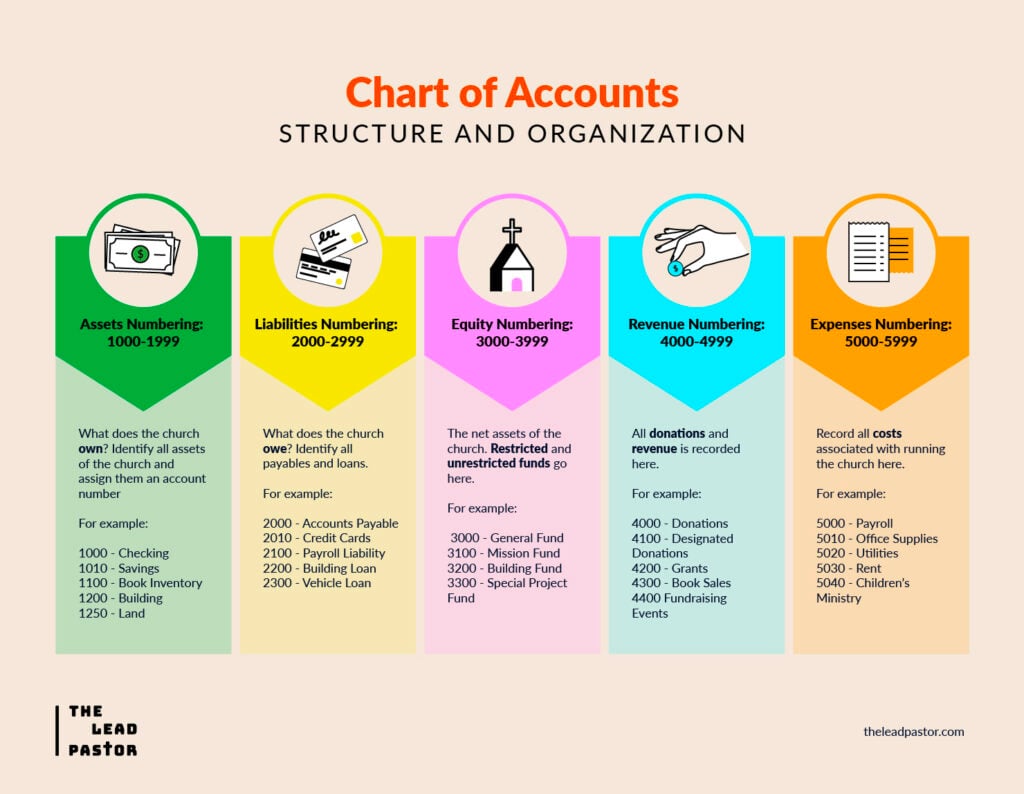

Step 1: Identify Key Account Categories

Start by breaking your accounts out into categories. They usually fall into five basic categories:

- Assets: Checking and savings account, inventory, accounts receivable, equipment, etc.

- Liabilities: Credit cards, current liabilities, long-term liabilities, mortgages

- Net Assets: All assets of the church minus all the liabilities

- Revenue: Income from donations, fundraising, or grants and investments

- Expenses: All costs associated with the running of the church

Step 2: Determine Specific Accounts for Each Category

Now that you have your categories, determine which accounts need to be included in each category. This will be tailored to the specifics of your church. You can decide how you want it to be organized. You might want to have an account for each ministry team that might receive income or incur costs. You can also create sub-accounts. For example, you can group your building costs, or the different supply costs (eg. paper supplies, coffee and refreshments, and stationary) might be categorized under one main account called Office Supplies.

Step 3: Assign Account Numbers

Assign a unique number to each account to simplify identification and data entry. A typical numbering system follows this pattern:

- 1000-1999 for Assets

- 2000-2999 for Liabilities

- 3000-3999 for Equity/Net Assets

- 4000-4999 for Revenue

- 5000-5999 for Expenses

Step 4: Review and Customize Based On Church Needs

Before finalizing the chart of accounts, review it to ensure it aligns with your church-specific needs. Consider whether the structure will adequately support future growth or changes. You can always go back and add or change anything later on if needed. Run a few transactions through it to ensure everything flows as expected and accounts are categorized correctly. This can help catch errors or inefficiencies before full implementation.

Step 5: Add Your Opening Balances

Unless you are a brand new church, you will have opening balances that you need to import into your new chart of accounts. If it is a brand new year, you will only import your Assets, Liabilities, and Equity. If it is partway through the year, you will need to bring in all the revenue and expenses for the current year.

2024's Top-Ranked Church Accounting Programs

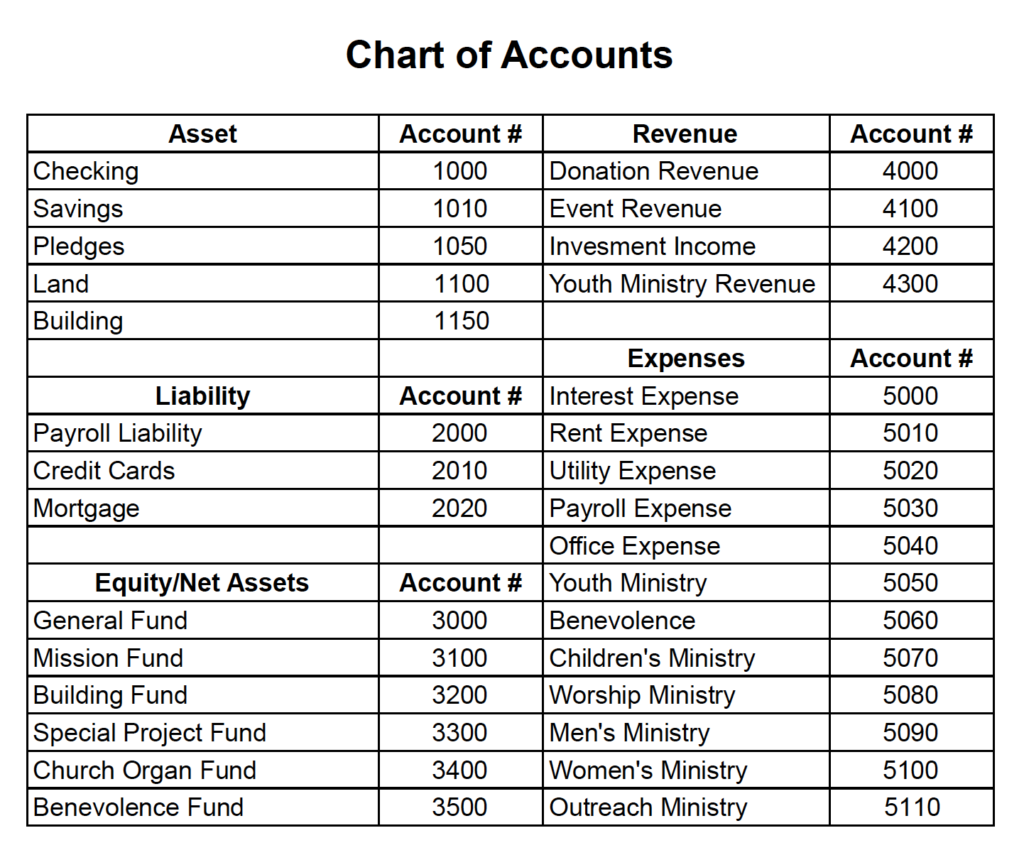

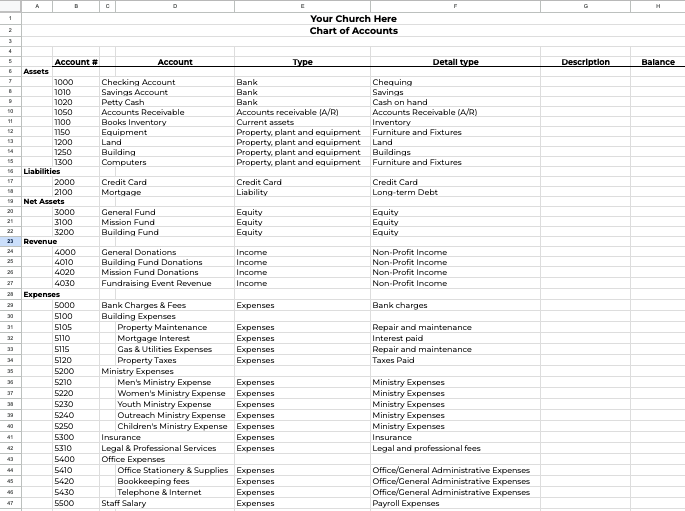

Free Downloadable Template

I’ve created a sample chart of accounts template to help you get started. Feel free to modify it for your purposes:

Church Chart Of Accounts Best Practices

Now that you have created your chart of accounts, you can use it to record your data, generate reports, keep track of the finances of the church, and store those church records for the right length of time. This is all part of the fundamentals of managing the church finances. Here are some of the best practices when it comes to managing your chart of accounts.

#1: Use Fund Accounting for Transparency.

Nonprofit organizations are required by the IRS to use fund accounting. The COA is where you will set this up. Fund accounting will keep track of the different types of donations you receive and ensure they are allocated to the right expenditures. This ensures transparency, helps track fund usage, and builds trust with donors by showing that designated gifts are used appropriately.

#2: Categorize Expenses by Ministry or Program.

Create expense accounts based on the associated ministry or program. This comes in handy when you are drafting the church budget or if you have requests for expenses for a specific team. Categorizing your expenses based on the ministry allows you to have the answers at hand when you need them.

#3: Regularly Review and Update the Chart of Accounts

The needs of the church will always be changing so it’s important to review and adjust the COA regularly to make sure that it is serving you well and that it accurately reflects the church’s financial state. Add or remove accounts as needed to keep the chart of accounts relevant. For example, if the church launches a new ministry or program, new accounts may be necessary. If a program ends, consider archiving or closing related accounts.

#4: Keep the Chart of Accounts Simple and Understandable

You don’t want to have too many accounts…but you don’t want to have too few either! It can be a balancing act to find the sweet spot. Avoid over-complicating the COA with too many accounts. Use sub-accounts whenever possible to group related expenses together for easy access and review.

For Further Learning

Setting up the chart of accounts in your accounting software is the first step towards managing the finances at your church. But don’t stop there. I’ve got more resources for you to keep on trekking. You’ll be an expert in no time!

- Craft and fine-tune your budget with A Pastor's Guide: How to Create a Church Budget.

- Keep those records safe and secure with The Pastor's Complete How-To Guide: Church Records Management.

You can learn more about managing the church finances here:

- Learn more nonprofit solutions from Springly.

- Go deeper into learning about the chart of accounts with ChurchTrack.com

- Discover the financial best practices for churches from MinistryBrands.com

Join The Lead Pastor Newsletter

Hear from seasoned pastors and church leaders with invaluable insights and proven strategies for ministry. Stay connected to help guide your church with confidence and clarity.

Subscribe now - we’d love to have you.