13 Best Church Accounting Software Shortlist

Here's my pick of the 13 best software from the 33 tools reviewed.

Our one-on-one guidance will help you find the perfect fit.

The best church accounting software helps pastors deliver clear financial reports, avoid budget mistakes, and stay IRS-compliant. It replaces scattered spreadsheets with a single, accurate system you and your bookkeeper can trust.

I've worked in church leadership for 20+ years. During that time, I've walked with dozens of pastors and churches all over North America. I once served with a pastor who spent several days prepping a quarterly board report—only to realize during the meeting he'd pulled the wrong designated fund total. The mistake delayed several key funding decisions, and took weeks to unravel. I've personally reviewed several dozen church accounting tools - any of which would have prevented that costly error.

Too many churches today are using manual or generic tools to track their finances - and face unclear reports and risky errors. The right software brings financial clarity, faster decisions, and deepens the trust between your members and leadership team alike. That's why the RIGHT software for your church matters - and this article will help you track it down.

Why You Should Trust My Reviews

Simply put, we’ve been testing and reviewing church accounting software for years now (since 2019). As pastors and church leaders ourselves, we understand how critical and how difficult it is to make the right decision when selecting accounting software.

To that end, we've invested significantly in deep research. Our team has tested over 2,000 tools for different church operations use cases and written over 1,000 comprehensive software reviews. (Learn how we stay transparent & our church accounting software review methodology)

The 13 Best Church Accounting Software Summary

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best accounting software for small churches | 30-day free trial | From $2/month (for 3 months, then $20/month) | Website | |

| 2 | Best for all-in-one church management | Free plan available | From $12/month | Website | |

| 3 | Best for managing church finances | Free plan available | From $19/month (billed annually) | Website | |

| 4 | Best for comprehensive bookkeeping | 30-day free trial | From $10.50/month (for 3 months, then $35/month) | Website | |

| 5 | Best for donation tracking | 30-day free trial | From $6.30/month (billed annually) | Website | |

| 6 | Best for AI-powered transaction matching | Free demo available | Pricing upon request | Website | |

| 7 | Best for user-friendliness | Free plan available | From $9/month | Website | |

| 8 | Best for donation syncing with Quickbooks | 30-day free trial | From $119/month | Website | |

| 9 | Best for financial discipline and transparency | Free trial available | Pricing upon request | Website | |

| 10 | Best for small churches | 30-day free trial | From $20/month | Website | |

| 11 | Best fund accounting for churches | Not available | Website | ||

| 12 | Best for budget management | Free demo available | Pricing available upon request | Website | |

| 13 | Best for financial planning & analysis | Not available | Pricing is available upon request | Website |

The Best Church Accounting Software Reviews

Here’s a brief description of each of the church accounting software on my list, showing what it does best, plus screenshots to showcase some of the features.

Xero is a cloud-based accounting software that allows businesses to manage their financials, including invoicing, bill payments, expenses, and bank reconciliation.

Why I Picked Xero: One thing that Xero is commonly praised for is its user-friendly interface and ease of use. Church leaders will find the software intuitive and simple to navigate, making it easy for them to manage their financial transactions and generate reports. This makes it great for small churches, who may not have time or energy to spend on learning new tools.

Xero can be used for church accounting needs by allowing the church to track their financial transactions, such as income from donations, expenses for events and programs, and payments for bills and expenses. It can also be used to generate financial reports, such as balance sheets and profit and loss statements, which can be useful for budgeting and decision-making.

Additionally, it can be used to manage the church's payroll and employee expenses, as well as track the church's assets and liabilities. Overall, Xero can provide churches with a comprehensive and efficient way to manage their financials, allowing them to focus on their mission and core activities.

Xero Standout Features & Integrations

Features include invoicing, bank reconciliation, expense management, financial reporting, payroll, multi-currency, mobile app, time tracking, collaboration, chart of accounts, and third-party integrations/add-ons.

Integrations include PayPal, Microsoft Outlook, MailChimp, HubSpot CRM, and others. You can access hundreds of more connections using Zapier, though it requires a separate subscription (free and paid options).

ChMeetings is a cloud-based Church Management Software (ChMS) designed to help faith-based organizations in the US, Canada, UK, Australia, and South Africa streamline their operations. Used by over 7,000 churches across these regions, it provides an intuitive, multilingual platform that simplifies church administration while remaining budget-friendly.

Why I picked ChMeetings: As a church accounting software, ChMeetings allows users to manage finances by tracking expenses, monitoring funds, and generating visual reports for financial insights. The software also integrates accounting functions with other church operations, enabling the addition and management of transactions, accounts, funds, categories, and payees. This integration helps churches maintain accurate financial records and perform reconciliations without requiring advanced accounting knowledge

Users can also create tailored budgets and track progress, giving visibility into available resources to help the church achieve its goals. Furthermore, the platform is known for accommodating different church sizes, with various priced plans and a free plan available.

ChMeetings Standout Features & Integrations

Features that make this software stand out include its all-in-one approach, with member profile management, event booking and check-in, outreach, confession appointments, event calendar, donations, online payment, ad-hoc forms, and granular access control. The platform is also GDPR-ready, secure, and available in multiple languages.

Integrations include MailChimp, PayPal, Twilio, and SMSGlobal. It also offers a developer API.

New Product Updates from ChMeetings

Event Sign-Ups with ChMeetings' Simple Registration

ChMeetings has introduced Simple Registration to ease event sign-ups by collecting only the primary registrant's details and the number of attendees, enhancing privacy and reducing data-entry workload. More details at ChMeetings Product Updates.

Gracely is a cloud-based church management software that helps ministries manage people, giving, events, and finances all in one place. It’s built specifically for churches, with user-friendly tools that support both day-to-day administration and big-picture financial stewardship.

Why I Picked Gracely: I chose Gracely because it makes managing church finances approachable without compromising on depth. You can track income and expenses, generate detailed reports, and see giving trends at a glance—all while maintaining transparency with your congregation. What stood out to me is how tightly integrated the online giving tools are with the financial reporting. You don’t need to pull data from different platforms to understand how your budget is doing or where your resources are going.

I also liked that Gracely is designed for volunteers and part-time staff. Its clean interface, guided setup, and centralized dashboards let you spend less time buried in spreadsheets and more time focused on ministry.

Gracely Standout Features & Integrations

Features include customizable forms for donations and event signups, attendance tracking, a secure member portal, and built-in tools to help you plan events and communicate with your congregation. You can manage multiple church groups, generate tax-ready contribution statements, and access role-based permissions to safeguard sensitive data.

Integrations include Stripe for payments and SendGrid for email communication.

New Product Updates from Gracely

Gracely's Update: New Customization Tools and Improvements

Gracely's weupdate introduces new customization tools, including integrated website building, custom fields, advanced filters, donation batches, and role creation, along with improved dashboard layouts and bug fixes. More details at Gracely Release Notes.

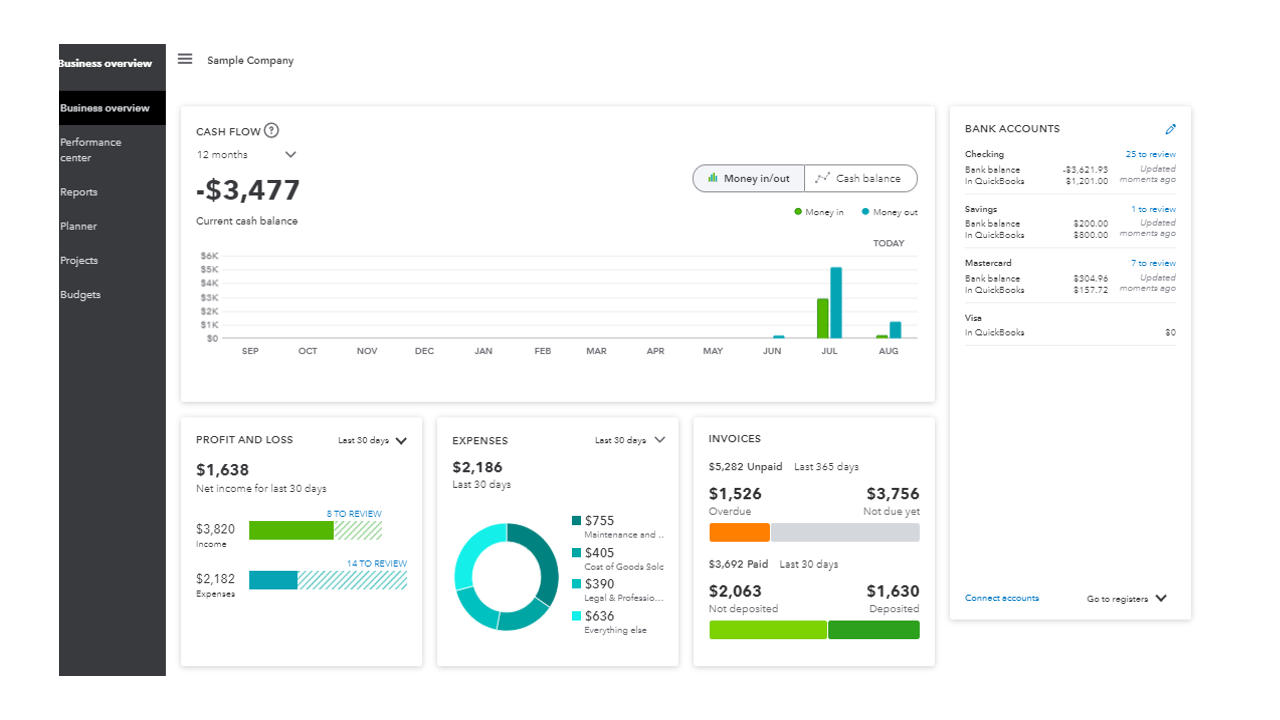

QuickBooks Online is a versatile, cloud-based accounting software tailored to meet the needs of small to medium-sized businesses, including specialized sectors like churches requiring unique financial management features. Its comprehensive set of features and user-friendly interface position it as a suitable choice for businesses seeking a robust bookkeeping solution that can handle a variety of financial tasks.

Why I picked QuickBooks Online: This software excels as church accounting software by offering customizable accounting solutions, donation tracking, and financial reporting tailored to the specific needs of religious organizations. Additionally, the software helps automate tax preparation for non-profits and maintain compliance with tax regulations.

A huge differentiator is its capability to automate various bookkeeping tasks, which can be particularly beneficial for churches with limited accounting staff.

QuickBooks Online Standout Features & Integrations

Features that make this software stand out include donation tracking which helps you simplify donation management which is critical for accurate donor records and financial transparency. Also, its fund accounting helps track designated funds and grants accurately.

Integrations include PayPal, Square, Shopify, Stripe, Gusto, TSheets, Bill.com, Hubdoc, Receipt Bank, Fathom.

FreshBooks is an accounting and invoicing software designed with small businesses in mind, including churches. It provides essential tools for managing finances, such as invoice creation, billing automation, and expense tracking.

Why I picked FreshBooks: FreshBooks stands out with its automated donation tracking feature, which simplifies the process of recording and acknowledging contributions. This functionality allows churches to manage donor information and generate year-end statements, ensuring transparency and fostering trust within the congregation.

Additionally, FreshBooks' detailed financial reporting tools provide insights into the church's financial health, aiding in informed decision-making.

FreshBooks Standout Features & Integrations

Features include automated billing, which allows churches to set up recurring invoices for regular donors or service fees, ensuring consistent cash flow. The bank reconciliation feature helps in matching bank transactions with recorded entries, maintaining accurate financial records.

Integrations include Zapier, Gusto, HubSpot, Square, FundBox, Google Sheets, PayPal, Mailchimp, WooCommerce, Airtable, Stripe, and Expensify.

New Product Updates from FreshBooks

FreshBooks' Key Updates: Manual Bank Creation and More

FreshBooks introduced key updates that include manual bank account creation, historical transaction imports, improved bank connections, financial lock, and streamlined payroll management. For more details, visit FreshBooks Product News.

DualEntry is an AI-driven ERP system that can help churches handle complex financial operations like fund accounting, multi-campus financial consolidation, and tax management. It’s designed to reduce manual data entry and can support high transaction volumes, which is especially useful for large or growing churches.

Why I Picked DualEntry: I picked DualEntry because it can help churches simplify their financial close process with AI-powered transaction matching and automatic reconciliations. This is especially helpful if your church manages multiple campuses or funds, since the software makes it easier to consolidate and report on your finances.

I also like that DualEntry is built with CPA-led support and a quick go-live process, which can ease the learning curve for church teams.

DualEntry Standout Features & Integrations:

Features include automated revenue recognition, detailed audit trails, and customizable dashboards for tracking fund balances and cash flow. DualEntry also includes tax management tools that integrate with Avalara and Vertex, helping you manage local tax reporting when needed.

Integrations include BambooHR, Bill.com, Brex, Deel, Google SSO, Gusto, HubSpot, Ramp, Rippling, Salesforce, Stripe Billing, and Stripe Invoicing.

Pros and cons

Pros:

- Automated revenue recognition ensures compliance with standards

- Supports multi-entity and multi-currency operations

- Advanced AI features help with complex accounting tasks

Cons:

- As an ERP, it may offer more features than needed for simpler accounting needs

- Customization options require careful setup

ChurchTrac is a church management software designed to help you oversee various aspects of your ministry, including accounting, membership, and event planning.

Why I picked ChurchTrac: I chose ChurchTrac for its user-friendly features. One such feature is its fund accounting capability, which lets you track fund balances accurately. This feature ensures that your designated funds are managed properly, helping you maintain financial transparency within your congregation. Additionally, ChurchTrac offers bank synchronization, allowing you to connect your bank accounts and import transactions quickly.

Another benefit is the import rules feature, which lets you set up custom rules to automatically categorize transactions. By assigning default categories and funds, you can ensure consistent and accurate financial records. This automation simplifies your bookkeeping tasks, allowing you to focus more on your ministry activities.

ChurchTrac Standout Features & Integrations

Features include church budgeting tools that let you create an annual budget and track expenses with built-in reports. The print checks feature supports various check styles and layouts, making it easier to manage payments. Additionally, the quick entry function allows you to set up recurring transactions.

Integrations include SendGrid, Stripe, and Mailchimp.

Tithe.ly is a church management system designed to help you manage your church’s finances, events, and community engagement through a centralized platform. It offers tools for digital giving, financial tracking, member management, and communication—all designed to simplify day-to-day church operations.

Why I Picked Tithe.ly: I picked Tithe.ly because of its digital giving tools, which make it easy for your congregation to donate via mobile, text, or online. These donations sync with QuickBooks Online, making it easier to manage finances and ensure accurate records without manual entry. Tithe.ly also supports recurring donations and provides reporting features that help track giving trends, offering clarity for financial oversight.

Additionally, Tithe.ly includes event management features that allow you to handle registrations and payments for gatherings of all sizes. Its customizable church app helps keep your community engaged throughout the week, providing a space to share updates, sermons, and announcements—all tailored to your congregation’s needs.

Tithe.ly Standout Features & Integrations

Features include a people database to track member engagement, a website builder to create a church website, messaging tools for text and email communications, kids’ check-in for added security, and background checks and training resources for maintaining safe environments.

Integrations include QuickBooks, RockRMS, Engiven, Salesforce, MinistryPlatform, Shelby, FellowshipOne, Planning Center Online, Church Community Builder, and Elvanto.

Realm is a comprehensive church management software designed to help churches grow and thrive. It offers a wide range of tools and services for pastoral care, administration, accounting, ministry, planning, stewardship, and more, all aimed at connecting the church community and empowering pastors to better care for their congregation.

Why I Picked Realm: Realm's church accounting software is designed to cater to the specific financial management needs of churches and religious organizations. It offers a suite of features that includes payroll processing, fund accounting, and integration with Realm Giving, which allows for the automatic posting of contributions as deposits into the general ledger.

The software supports both cash and accrual-based accounting methods, ensuring compliance with accounting standards and accurate record-keeping. Users can organize their chart of accounts by fund, track income and expenses, manage disbursements such as bill payments and check printing, and reconcile bank and credit card statements.

Additionally, Realm provides tools for tracking vendors and transactions, budgeting, and generating customizable reports to review financial details. Overall, this comprehensive solution aims to assist churches in maintaining solid financial discipline and providing transparency to congregations and vendors.

Realm Standout Features & Integrations

Features include account segments for more detailed reporting of transactions as well as tools for administrative tasks, like volunteer management, background checks, event management, and reporting. Realm also offers mobile apps for better congregation connectivity.

Integrations include Verified First, Nelco, Constant Contact, Growth Method, Go Method, Vanco, and more.

AccountEdge Pro is a small business accounting software that provides advanced financial management and inventory tracking tools.

Why I Picked AccountEdge Pro: AccountEdge Pro is a comprehensive accounting software designed for small businesses (or churches) that provides advanced financial management and inventory tracking tools. AccountEdge Pro offers a wide range of financial management tools such as invoicing, billing, and tracking of expenses. It also provides detailed financial reporting and analysis capabilities, allowing users to track their business's financial performance and make informed business decisions.

AccountEdge Pro is designed to be user-friendly and easy to navigate, allowing users to quickly and easily manage their finances and inventory. It also offers a variety of tutorials and support resources to help users get started.

AccountEdge Pro has inventory tracking and sales tax calculations if you sell anything through the church, like Bibles, t-shirts, or event tickets.

The one-time fee option for Windows is great for churches who aren't looking for a monthly software-as-a-service subscription, which can really add up cost-wise over time. One payment and you own it forever. Unfortunately, the single-use license isn't available for Mac, which offers a per-month subscription only.

AccountEdge Pro Standout Features & Integrations

Features include financial management, inventory management, contact management, sales tax, payroll, time billing, job costing, multi-currency, and third-party integrations/add-ons.

Integrations include QuickBooks, Salesforce, Square, Microsoft Excel, TSheets, Harvest, and most bank feeds.

Other Options: Our Honorable Mentions

While these ones didn’t crack our top 13, they’re worth mentioning (and worth exploring for you, as well!)

- MIP Fund Accounting

For flexible accounting reports

- Botkeeper

For AI-automated bookkeeping

- PowerChurch Plus

All-in-one ChMS system

- ZipBooks

For free church bookkeeping

- Fyle

For expense tracking

- Sage Intacct

For scalability

- MinistryPlatform

For large churches

- SteepleMate

For centralized financial tracking

- Breeze ChMS

For ease of use

- Gusto

For payroll systems

- CDM+

For church event budgets

- ChurchPro

All-in-one church management solution

- WAVE

For a simple bookkeeping and payments option

- FlockBase

Fully-featured & affordable option

- MartusTools

For budgeting & reporting

- Jewel

For check payments & tracking

- ShelbyNext

For complex church payroll needs

- Paxton Charities Accounting

For UK-based churches

- Givelify

For mobile giving

- ExpensePlus

For midsized churches

Related Church Software Reviews

Most churches rely on software tools to keep things organized and working smoothly. We've thoroughly researched the top industry tools available to simplify your decisions. Our reviews will help you:

- Reduce your admin load with industry-leading church management solutions.

- Keep payroll working without hiccups with the best church payroll software

- Explore the top Quickbooks alternatives for your church accounting

Selection Criteria for Church Accounting Software

When evaluating church accounting software, I prioritize functionality and meeting specific news that most impact your efficient financial management. The right tool for your church should alleviate pain points, offer intuitive workflows, and align with your church's unique needs. It should streamline your church bookkeeping/church finances.

I've personally tried and researched these tools, and my selection criteria focuses on these critical factors:

Core Software Functionality - 25% of Total Weighting Score:

Standard features for church accounting software typically include fund accounting, donation tracking, church budgeting, payroll management, customizable reports, bank reconciliation, volunteer/staff permissions, multi-site support, and integration with donor management systems.

To be considered for inclusion on my list of the best church accounting software, the solution had to support the ability to fulfill common use cases:

- Managing designated funds for specific projects

- Tracking and acknowledging donor contributions

- Providing transparent financial reports for the congregation and board

- Automating payroll processing for staff and clergy

- Simplifying budgeting and expense forecasting

- Streamline church bookkeeping

Additional Standout Features - 25% of Total Weighting Score:

- Advanced Fund Accounting: Support for endowment funds or restricted donations not offered by generic accounting solutions.

- Integrated Donor Management: Tight integration with CRM systems (like Breeze or DonorPerfect), preventing duplicate entries and streamlining financial reporting.

- Multi-Campus Management: The ability to manage church financials across multiple campuses with consolidated reporting (like that offered by ACS Technologies)

- Customizable Role-Based Permissions: Ensure sensitive data remains secure while empowering staff and volunteers.

- Innovative Reporting Tools: Tailored financial statements and forecasting tools (like Aplos) provide new insights for strategic planning.

Usability - 10% of Total Weighting Score:

- User-Friendly Interface: Clear, organized dashboard with easy navigation.

- Customizable Dashboards: Tailor the display to prioritize relevant financial information.

- Drag-and-Drop Functionality: Streamline workflow adjustments, especially in budgeting and reporting.

- Role-Based Access: Easy-to-configure permissions for staff and volunteers.

Onboarding - 10% of Total Weighting Score:

- Interactive Product Tours: Hands-on experience that guides new users through the basics.

- Training Videos and Webinars: Practical resources that shorten the learning curve.

- Templates for Setup: Pre-built templates to simplify data migration.

- Chatbots and Help Guides: Provide quick answers to common questions.

Customer Support - 10% of Total Weighting Score:

- 24/7 Support Availability: Ensure help is always available, especially during crucial periods like year-end closing.

- Dedicated Account Manager: Personalized assistance for setup and troubleshooting.

- Live Chat Support: Real-time solutions to minimize workflow disruption.

- Comprehensive Knowledge Base: Articles and guides for self-service problem solving.

Value for Money - 10% of Total Weighting Score:

- Transparent Pricing: Clear tiers with no hidden fees.

- Flexible Plans: Monthly and annual plans that fit different budgets.

- Scalable Solutions: Features that grow with the church, adding value over time.

- Free Trials: Allow testing before committing.

Customer Reviews - 10% of Total Weighting Score:

- Consistent Positive Feedback: High satisfaction rates among similar-sized churches.

- Ease of Implementation: Quick setup times with minimal issues reported.

- Reliable Support: Responsive and knowledgeable support staff.

- Feature Effectiveness: Users highlight standout features that provide unique value.

Selecting the right church accounting software requires carefully evaluating how well each option fulfills these criteria. By focusing on your church's needs, bottlenecks, or pain points, you can more confidently choose a solution that aligns with your church's mission and financial goals.

How to Choose Church Accounting Software

Every church has a different decision-making process, but some essentials apply across the board. When choosing accounting software, here’s what to prioritize:

1. Strong Budgeting & Fund Tracking

Church budgets are tight. Your software should make it easy to track income and expenses across multiple funds—like keeping mission fund donations separate from the general fund.

2. Donation Tracking & Reporting

Accurate donor records aren’t optional. The right software automates tax receipts, contribution summaries, and fund-specific reports—helping you track gifts for building projects, outreach, and designated funds without extra work.

3. Simple, Volunteer-Friendly Interface

Most churches rely on volunteers for accounting. Choose software that’s easy to learn with clear dashboards so non-accountants can track finances without a steep learning curve.

4. Seamless Integration with Your Church Systems

Double data entry wastes time. If your church already uses Planning Center, Fellowship One, or another management tool, pick accounting software that syncs to keep records accurate and up to date.

5. Built-in Compliance & Audit Support

Churches face financial oversight. The best software simplifies audits, ensures transparency, and keeps you compliant with features like audit trails, customizable charts of accounts, and fund accounting.

Need a solution that goes beyond accounting? Most of the top church management software tools offer accounting support - in the context of an all-in-one system. And, should you need it, there are some excellent donor management software tools available as well.

Trends in Church Accounting Software

Church accounting software continues to evolve, driven by the need for better efficiency, transparency, and compliance. We analyzed product updates, release notes, and announcements from key players like Aplos, QuickBooks for Nonprofits, and Breeze. Here’s where church financial management is headed this year:

Smarter Automation & Integration

- Donor Management Sync – Platforms like Aplos and QuickBooks now offer deeper donor management integration, cutting manual data entry.

- Automated Bank Reconciliation – New features (e.g., ACS Technologies) match transactions instantly, saving hours.

- API & Webhooks – Advanced users can now seamlessly connect accounting systems with church management tools.

Better Financial Oversight

- Custom Reports for Boards & Donors – Aplos and Church Community Builder now provide fully tailored financial statements to improve transparency.

- Real-Time Dashboards – QuickBooks and Breeze have upgraded dashboards for instant insights into giving, fund balances, and budgets.

- Predictive Analytics – Pushpay and Planning Center now offer AI-driven budgeting tools to forecast expenses with greater accuracy.

Stronger Compliance & Security

- Easier Tax Reporting – 2025 updates simplify year-end contribution statements and 1099 filings.

- Role-Based Access – Better permission settings protect sensitive data and ensure policy compliance.

Better User Experience

- Simpler Interfaces – QuickBooks, Breeze, and Aplos have streamlined their designs for easier navigation—especially for non-accountants.

- Expanded Knowledge Bases – ACS Technologies and Planning Center now offer detailed guides and video tutorials, reducing support tickets.

What’s Fading Out?

- Printed Reports – Digital dashboards and automated statements are replacing paper reports.

- Basic Bookkeeping – Churches are moving beyond simple bookkeeping to specialized financial tools built for ministry needs.

These changes show that the right software isn’t just about tracking money—it’s about helping pastors lead with clarity and confidence.

What is Church Accounting Software?

Church accounting software is a tool that organizes your church’s finances. It allows you to control, review, and organize donations, payroll, fund tracking, and budgeting all in one place. Whether you're leading a small congregation or a multi-campus church, church accounting software helps simplify finances so you can focus on ministry.

Features of Church Accounting Software

Choosing the right software can make or break your church’s financial management. Here’s what matters most:

- Fund Accounting – Track designated funds accurately.

- Donation Tracking – Simplify donor contributions and receipt generation.

- Budgeting & Forecasting – Plan for future expenses and avoid overspending.

- Custom Financial Reports – Generate tailored reports for boards, donors, and compliance.

- Payroll Management – Handle clergy and staff payroll within the same system.

- Bank Reconciliation – Instantly match transactions and reduce errors.

- User Permissions – Set role-based access to protect financial data.

- Donor Management Integration – Sync with donor platforms for seamless reporting.

- Multi-Site Support – Manage multiple campuses while keeping accounts separate.

- Scalability – Ensure the software grows with your church as giving and ministry expand.

These features form the foundation of effective church accounting software. They help reduce administrative burdens, maintain transparency, and support strategic financial planning, ultimately empowering your church to focus on its mission.

Benefits of Church Accounting Software

Managing church finances without the right software leads to errors, wasted time, and financial blind spots. The best church accounting software does more than crunch numbers—it keeps your church financially healthy and ministry-focused.

5 Key Benefits for Lead Pastors:

- Accurate Fund Tracking – Keep designated funds organized and compliant.

- Simplified Donation Management – Automate contribution tracking and reporting.

- Clear Financial Reporting – Get real-time financial insights for better decisions.

- Effortless Payroll Processing – Ensure accurate clergy and staff compensation.

- Time-Saving Automation – Free up staff hours for ministry instead of paperwork.

By staying ahead of these trends, pastors can lead with confidence, knowing their churches have the right tools for financial clarity, integrity, and growth.

Using specialized accounting software helps pastors focus on their core calling while leaving the intricacies of financial management to the experts.

Joshua GOrdon

Costs & Pricing for Church Accounting Software

Pricing plans typically vary based on the church's size, complexity of financial needs, and desired features. Here's a breakdown of plan types and pricing options most common in the industry:

| Plan Type | Average Price | Common Features | Best for... |

|---|---|---|---|

| Free | $0/month | Bookkeeping, fund accounting, donation tracking, basic reporting, volunteer permissions | Small churches with straightforward financial needs |

| Basic | $25-$50/month | All Free features, budgeting, payroll processing, bank reconciliation | Medium-sized churches requiring payroll and budgeting capabilities |

| Standard | $50-$100/month | All Basic features, multi-site support, role-based permissions, custom reports | Larger churches needing comprehensive financial management and team collaboration |

| Advanced | $100-$200/month | All Standard features, donor management integration, advanced analytics, mobile app | Large churches with complex financial operations and specific customization needs |

| Enterprise | $200+/month | All Advanced features, unlimited users, dedicated account manager, API access | Mega churches or organizations with highly complex and large-scale financial operations |

Selecting the right plan depends on your church's size and specific financial management needs. Consider starting with a free or basic plan to explore features. From there, commit to a more comprehensive option as your needs expand.

Frequently Asked Questions

How secure is church accounting software, and can it protect sensitive financial information?

Can I migrate existing financial data from our current system into new church accounting software?

How does church accounting software handle multiple currencies for international missions or donations?

Is it possible to integrate church accounting software with our existing church management system (ChMS)?

Join Our Newsletter.

We want everything we publish to be so good it's worth paying for... not that you'll pay for the newsletter. It's free. As a subscriber, you'll get:

- Seasoned insight from veteran pastors and church leaders. We'll connect you with folks who know the deep grind of pastoral ministry, and share their hard-earned wisdom.

- Tangible, practical, applicable resources (templates, downloads, etc) to simplify your load of administrative tasks.