There’s nothing as thrilling as sitting down to work on your church financial report... said no one ever! At least not most lead pastors. And who can blame them?

If you’re like most lead pastors, the work of creating church finance reports (using church financial software, examining balance sheets, checking the bookkeeping, or calculating liabilities) is likely not in line with your top gifts.

But, God is interested in each church's financial health - and church finance reports are a big part of that.

I'm Joshua Gordon, and for over two decades I've held various church leadership roles (paid and volunteer), including helping to plant New Life Fellowship in Cambridge, Ontario, Canada.

I'm going to pass on what I've learned.

So, I'm going to break down everything you need to know to have a stress free church financial report. Along the way, we’ll give you some examples and checklists to help you get started. By following these tips, you’ll be able to generate church financial reports that are clear, transparent, and informative!

After all, when your church finances follow the pastoral vision and direction, then trust and accountability between your church and its members will grow. Your people will have a greater willingness (and excitement) to support the church’s mission with their time, energy, and money.

I wrote this article in conjuction with Jim Gordon, the senior pastor of Elora Road Christian Fellowship. Jim has been leading ERCF for 20+ years; in that time, he's seen it all - and understands the ins and outs of managing a church's financial health.

Church finance reports bring clarity and shine a light on your current financial circumstances. Even if what you see is discouraging, you and your leadership team will be equipped to plan for a better financial future.

This article covers:

- What Is A Church Finance Report?

- How Do Church Finance Reports Help?

- Who Is A Church Finance Report For?

- What Goes Into A Church Finance Report?

- Church Finance Report Checklist (Free Download)

What Is a Church Financial Report?

A church financial report is, simply, a snapshot of your church’s current financial situation. It should paint a clear, accurate picture of the current financial status of your church... so, it's not meant to be a budget. It's not meant to be a forecast.

Finance reports like this are are typically created monthly (but sometimes quarterly, or annually depending on the report's intended audience - more on that in a second.) When considering how often you need these created, consider the following:

- What legal and regulatory requirements apply to you?

- Who are the key stakeholders (donors, leadership, finance committee, board of directors, etc.), and what do they need?

- What is your current financial planning and budgeting cycle?

- How financially stable and complex is your church?

All of these questions factor into this conversation.

Who is Involved in the Development of a Church Financial Report?

Typically, a church finance committee or board of directors takes the lead on this (often aided by church accounting software tools), as they are responsible for providing oversight and direction. Often, the treasurer will work alongside a bookkeeper or accountant (hire or outsource if necessary) to present the church report. If you don’t yet have a board or church finance committee in place, this is a great time to recruit a team of qualified volunteers.

Pastors, your role is also key, as Jim Gordon unpacks in more detail here:

How Do Church Finance Reports Help?

Church finance reports are a part of good stewardship.

I've yet to meet a pastor NOT concerned with stewardship. This calling we have embraced is one of close dependance on Jesus - and a reliance on His provision. God has promised to provide for our needs, but Scripture is still packed with directives to steward our resources well.

A church financial report helps our efforts to steward our resources well by giving real time picture of the financial situation. If we fail to use church finance reports, we choose to make decisions blindly, without concern for the consequences. (Financial management and accountability are important parts of developing trust and confidence in your congregation as well.)

Church finance reports inform effective planning.

A church finance report, by giving a snapshot in time of your church's health, greatly supports your budgeting and planning efforts. You and your leadership team will be equipped to identify and respond to trends, manage your resources effectively, and manage and mitigate financial risks. Ultimately, church finance reports are real time feedback on your church's operational and administrative decisions.

Church finance reports protect the church.

Church finance reports make it much harder for financial problems to grow and develop out of sight. Issues are nipped in the bud. A church financial report provides transparency by detailing the sources of income and how funds are spent, ensuring accountability - not only to the congregation, but also to your church's board of directors, finance committee, etc.

Church finance reports are* required by banks or the government.

Church financial report assists with compliance by ensuring adherence to legal and regulatory requirements governing financial transparency and reporting. Monthly reports (for example) show a track record of financial transactions and decisions, which can be helpful if your church is needing financing for a building, etc. Some regulatory bodies require regular reports as well (IRS or CRA) - though we recommend you follow-up with your accountant for specific advice on your situation.

*occasionally

Who Is A Church Financial Statement For?

Church finance reports may change in their scope and complexity, depending on who the report is for:

- Church leaders need accurate, up-to-date financial information in order to make wise spending decisions and identify trends. Your church finance committee or board of directors may need monthly statements to track spending vs actual, approve larger expenditures, or keep a close eye on recent trends.

- Church members, depending on your church's legal structure, may need to see church finance reports (likely annually) to validate that the church is demonstrating trustworthiness. Even churches who are not member-led will occasionally generate simple financial statements to help the congregation see how the church's mission and vision is being fulfilled through the finances. This helps them connect to their giving, and know that it’s meaningful.

- Regulatory bodies and authorities in your region may require clear, accurate reports such as an annual financial report, or when needed, audited financial statements. Some banks require them as well when applying for a loan, line of credit, or mortgage.

What Are the Core Components of a Church Financial Report?

There are a handful of components that make up a church financial report. Each is a vital tool for both internal management and external stakeholders to understand the financial position of your church. Let’s break it down!

The Income Statement..

...summarizes the church's revenues and expenses over a specific period, typically detailing sources of income (e.g., donations, tithes, grants) and church expenses (e.g., salaries, utilities, equipment, maintenance).

The Balance Sheet...

..provides an overview of the church's assets, liabilities, and net assets (or equity) at a particular point in time. This helps assess the overall financial health.

The Cash Flow Statement...

...tracks the flow of cash into and out of the church during a specified period, providing insights into the financial health and operational efficiency.

The Budget Comparison...

...shows actual financial performance alongside the budgeted amounts, helping identify areas of over- or under-spending, and informing future budgeting decisions.

Contextual Notes...

...provide additional context or explanations that may be needed. If facilities spending is substantially higher because the church building needed a new furnace this month, ensure that additional context is noted in the report.

Free Checklist: Church Finance Report Checklist

Let’s go over exactly how to develop the report. If this is your first time developing a financial statement, keep this in mind: progress over perfection. This isn’t an audit, it’s just a way of organizing all the relevant information, and it’ll take time to get the hang of it.

Step 1. Gather Financial Data

Collect relevant data for the reporting period (income, expenses, assets, liabilities, etc.). You can find what you need in your accounting software, bank statements, cash flow statements, receipts, and invoices.

- Income Sources:

- Tithes and Offerings: Record total contributions received from members and other donors.

- Fundraising Events: Include proceeds from any special events or campaigns.

- Rental Income: Note any revenue generated from renting out church facilities.

- Expenses:

- Operating Expenses: List expenditures related to day-to-day operations, such as utilities, salaries, and office supplies.

- Program Expenses: Detail costs associated with ministry programs, events, and outreach activities (youth ministry, children's minstry, missions, audio/visual, tech, etc)

- Facility Maintenance: Include expenses for building maintenance, repairs, and renovations.

- Assets:

- Cash Reserves: Determine the amount of cash held in bank accounts or reserves.

- Property and Equipment: Assess the value of church-owned property, buildings, vehicles, and equipment.

- Investments: Record any investments held by the church, such as stocks, bonds, or mutual funds.

- Liabilities:

- Loans and Debts: List any outstanding loans or debts owed by the church.

- Debt Payments: Record payments towards loans or mortgages.

- Accounts Payable: Include unpaid bills or invoices for goods and services received.

- Budget Comparison: Compare actual income and expenses against the budgeted amounts for the reporting period.

- Financial Statements:

- Profit and Loss Statement: Summarize revenues, expenses, and net income or loss for the reporting period.

- Balance Sheet: Provide a snapshot of the church's financial position, showing assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: Outline cash inflows and outflows to assess the church's liquidity and ability to meet financial obligations.

- Variances: Analyze any discrepancies between budgeted and actual figures and identify reasons for the differences.

- Budget vs. Actual:

- Compare actual income and expenses against the budgeted amounts for the reporting period.

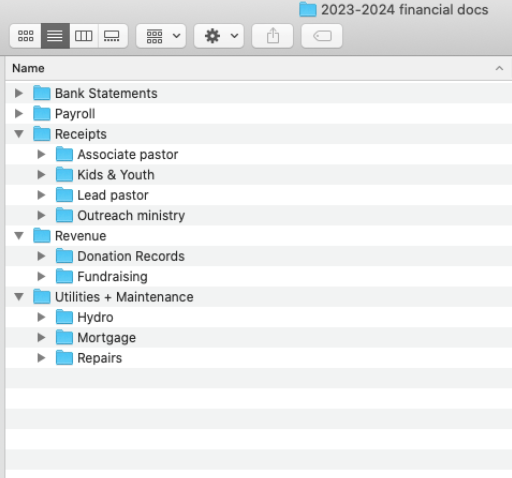

Step 2. Organize the Data

Once you’ve gathered the data, we recommend organizing each report’s source data into well-labeled (include dates!) folders or digital files, grouped by source (i.e.: bank statements, donation records, expense receipts, payroll, vendors, etc.). Use subfolders as necessary... here's a quick screengrab of a sample:

3. Prepare the Income Statement (Profit & Loss Statement)

List all revenue, deduct all expenses and calculate net income or loss for the reporting period (i.e., the month, quarter, or whole year). Your church accounting or bookkeeping software should be able to generate this report. If not, consider switching to one that DOES - but in the meantime, Google offers a sample P&L worksheet.

4. Prepare the Balance Sheet

Your church's balance sheet simply reports what is owned (assets), and what is owed (liabilities). When you combine the two, you get your net assets. (As before, your church's accounting program should be able to generate this for you. If not - change it! Or, Google Docs has a free template worth reviewing.)

5. Prepare the Cashflow Statement

Classify your church's cash flow into three categories - operating, investing, and financing.

- Cash from Operating Activities: inclues cash received from sales, paid for supplies, wages, and other operational expenses.

- Cash from Investing Activities: This covers cash used for or generated from buying/ selling assets (equipment, investments, etc.)

- Cash from Financing Activities: This involves cash received from loans or investors and cash paid as dividends or for loan repayments.

6. Prepare the Budget Comparison

Compare the actual income and expenses for the reporting period with the budgeted amounts for the same time frame.

- Include figures for what was allocated for each category (e.g., utilities, salaries, ministry expenses).

- Actual amounts for the same categories.

- Calculate the percentage difference between the budget and actual spending for each categorize.

- Show percentage increases or decreases for quick visualization of changes in spending priorities or needs.

7. Provide additional explanatory notes

Give any necessary context and explain any unusual transactions to enhance understanding of the data. You can also include a brief written summary or overview here. Think of it as a pre-emptive FAQ section, if you will.

Additional Helpful Tools

The following tools will really help you track your church finances and generate quick, simple, accurate reports:

- Streamline your day-to-day bookkeeping with church bookkeeping software.

- Review some of the best software we've found for tracking your church's finances.

- We've researched the top software tools to assist with your church's giving.

Critical Reminders

1. Don’t AVOID the reality of your church’s finances.

Discussing money can be uncomfortable, but it was definitely not a topic Jesus shied away from, and neither should we. For those of us who with a natural aversion to finances, money can be a tool for spiritual formation - the arena where Jesus teaches us trust, faith, and vulnerability.

That being said: Every lead pastor needs the support of a team of people who provide financial insight and oversight - the church finance committee (or board of directors). If you don’t have that yet, trust that the right people are out there, pray for God to lead you to them, then start to look.

2. Don’t become financially obsessed.

Even in the messiness of finances, your job is to trust and rely on God's provision, and model this to your congregation. After all, the local church matters to Him. A few things to mind as you seek to balance active financial management with trust in God's provision:

- Prayerful dependence: Consistently talk to God about the stress and weight you feel. He's promised to carry that for you. Do this individually, but also as a leadership team, and as a church. Remember: God promised to build His church - so the gates of hell would NOT prevail against it (Matthew 16:18.)

- Integrity in financial management: As you oversee your church's finances, prioritize your integrity. We are accountable to God for how we handle His provision. Shortcuts may be tempting - but don't compromise. Don't give our enemy a foothold (Ephesians 4:27.)

- Faith in God's promises: Ground your financial decisions and planning in the promises of God's Word. Trust in His faithfulness to provide for your needs - and hold your plans loosely. James encourages us to be mindful of our limited perspective and submit our plans to Jesus (James 4:13-15.)

- Generosity and kingdom focus: Encourage a culture of generosity within your church, where members joyfully give to God's work as He leads. Emphasize the eternal impact of investing in God's kingdom rather than solely focusing on temporal concerns. Your church can foster a culture of faith-filled stewardship, where active financial management is coupled with dependence on God's provision, “And my God will supply all your needs according to His riches in glory in Christ Jesus,” Philippians 4:19.

3. Don’t carry the weight of your church finances alone.

By involving others and sharing the load, you alleviate stress and cultivate a community where everyone plays a part in what God's doing.

As a church leader, you are entrusted with responsibility of guiding your church. However, the expectations placed on leadership do not include shouldering the financial responsibilities single-handedly. That’s not how God designed the body of Christ to operate. Instead, you need to have a group of people who together carry the weight of the finances.

A Final Encouragement

If your church is a car, there's a back seat and a front seat.

In the front seat, you have vision and values, and in the back seat you have administration and finances. When administration and finances are not in the car, the vehicle is going to crash. But if they’re in the front seat, you’re not going to move.

Administration and finances are critical - but they ultimately take a backseat to vision and values... and for those, we get our marching orders from Jesus:

...proclaim good news to the poor, liberty to the captives, recovery of sight to the blind, to set at liberty those who are oppressed, and to proclaim the year of the Lord's favor.

Luke 4:16-21

For more seasoned insights from veteran pastors...

...join The Lead Pastor newsletter. We'd love to have you.